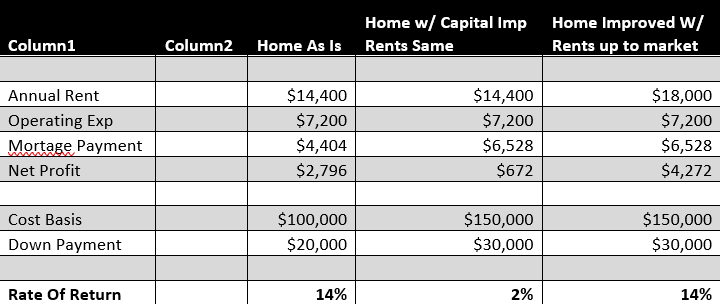

To whomever may care, My name is Matt Drouin. I own a real estate development company and have been providing high quality market rate housing in the City Of Rochester for 15 years… it's story time... “I’M GOING TO F****** KILL YOU! OPEN THE DOOR! OPEN! THE! DOOR!” BANG BANG BANG BANG BANG BANG BANG BANG 2:37am – I look over at my phone and realize what time it is. Then I hear my 18 month year old daughter screaming in her bedroom. I’m wondering, “What in the hell is going on?” BANG BANG BANG “OPEN UP THE F****** DOOR YOU GOD DAMN MOTHER F*****!” I look out the window next door and it’s some woman clearly out of her mind coming down off some substance; trying to scratch an itch. Pounding on my neighbor’s door. The reason I know this? My neighbor who moved in several months ago is a drug dealer. How do I know this? Comings and goings of random people all night and all day. This isn’t friendly house calls. It's trembling people. Dark circles under their eyes, who look like they haven’t slept in days. People who ask me for money or cigarettes or looking to sell me something hot and convert it to cash to patronize my next door neighbor. I have contacted their landlord Providence Housing (A supportive/transitional housing agency) and they can do nothing. They say they don’t have the evidence they need like police incident reports to get my enterprising neighbor out. I have called the police several times upon incidents like these and by the time they get to the scene (which is usually quite a long time.) The “customers” have disappeared or are inside the dealer’s apartment. No incident to report. The officer instructs me to call the neighborhood service center to report these types of things. Basically saying in not so many words, “we have enough to deal with right now, call us when this thing really blows up.” I usually come back into the house, and expect the usual admonishment from my wife. “Don’t call the police! What if that guy does something to us?” We then live the next few days with our neighbor staring us down when we see him out front of our house and us having to leave all the lights on in the house. Make sure every door is locked. Security system is armed. Sleeping lightly or not at all. Stirring at every little sound. Hoping for the best. Praying for no retaliation. I contact the Neighborhood Service Center and they tell me to call the police with issues like this. What can be done? Apparently, nothing. What does this little story have to do with housing policy? Well, under usual circumstances, the landlord, Providence Housing, might not be able to get this neighborhood terrorist out through traditional eviction (because there is not enough bona fide evidence to hold up in eviction court), but would be able to get them out when their lease expires through what’s called a hold over proceeding. A hold over proceeding is when a landlord gives notice to a tenant that they are deciding not to renew their lease when it expires. If the tenant overstays beyond their lease expiration (aka holding over) the landlord can file for eviction in order to recover possession of the rental home. There may be many factors in why a landlord may decide not to renew a tenant’s lease, but the most common one is behavioral. Behavioral issues like my neighbor. Being a nuisance to neighbors or any type of irresponsible behavior that affects the neighborhood or property in a negative way. Under new legislation being considered by city council, my enterprising next door neighbor would have the right to lifetime tenancy with little to no recourse besides me taking matters into my own hands or moving out of the city. Neither of which option is particularly attractive. This legislation is called the Good Cause Eviction law (which was just passed in Albany; the text of the law is in the file above.), which would give a tenant the right to stay in their apartment or rental house for their entire life if they chose to, as long as there wasn’t a “Good Cause” to evict them. A “Good Cause” to evict would be nonpayment of rent. Unless crack cocaine and heroin becomes legal, I don’t see an interruption of income to my neighbor happening anytime soon. A “Good Cause” to evict would be documented behavioral issues, like police reports. Like I had mentioned earlier, I haven’t been able to get any police reports because apparently there isn’t anything to report. My good neighbors, mostly Providence Housing residents, do not want to call the police or the neighborhood service center because they are afraid. If you don’t think this fear is real, you are out of touch. A fifteen-year-old was just shot and killed in our city with no suspects and no person of interest. How many times do we hear about a child being murdered in our streets and even their parents are afraid to cooperate with the police? If this story wasn’t enough for you to question Good Cause Eviction, keep reading… There is an affordable housing crisis in Rochester that has been around long before housing affordability became a topic of discussion with policy makers like yourselves. According to the National Low Income Housing Coalition, Monroe County has a shortage of over 50,000 affordable housing units, with most of that housing need being in the city of Rochester. This means that there are over 50,000 households that do not have housing or are burdened by housing costs as it relates to their income (spend at least 30% of their income towards housing costs.) These facts when compared to what you see in the media about the great affordability of housing in the Rochester region are simply confusing. How can we have some of the least expensive housing in the nation for a metropolitan area yet have this housing affordability crisis? (In fact, there are many areas of the city where the housing is so cheap, banks wont even provide financing.) The short answer lies in income inequality not housing cost. We have an income problem, not a cost of housing problem. Combine this with the trend of suburban (mostly) white people desiring to live in dense urban environments and you have what looks like gentrification, or colonization. So it becomes very easy for policy makers to go to the root of the problem at face value, and want to support policies that will curb the increases in the rents that outpace local incomes. It is no wonder why you support Rent Control aka Good Cause Eviction in Rochester, NY. It’s a quick fix. Quick fixes are never good. As Italian philosopher Umberto Eco once said: “for every complex problem there’s a simple solution, and it’s wrong” Here are some reasons why the Rent Control legislation you are considering is short sighted and disastrous towards race equity, creating housing options for low to moderate income renters, and even deleterious to current quality housing options. Any new housing is good housing. We need more housing units in our community. Not just the low income housing units as created by the Low Income Housing Tax Credit through affordable housing developers. This is important, but also preserving investment in existing housing stock, as well as creation of luxury housing for high income earners that choose to live in our city. Fact, increasing supply moderates rental rate increases over time. Fact, it broadens the tax base to support city programs. Fact, higher income earners are usually not net consumers of public resources. And luxury housing, most namely decreases competition amongst tenants over rental units that were originally out of reach to them in middle to upper middle income areas like the South Wedge, Park Avenue, and Pearl Meigs Monroe, just to name a few. The reason why I name these neighborhoods is simply because this is where most of my properties are. With the increase in supply of “luxury” apartments, we have seen the average income of our applicants go down as our high income tenants have left our communities to relocate to amenity rich high income housing. This is not necessarily a bad thing. The tenants what we were getting before "luxury" supply went up were making sometimes $75,000 to $100,000 annually on average and applying for an $800-$900 apartment home that we had. Now that they have more options, they are gravitating towards higher priced units. What we have seen in response to this phenomena is that there are more BIPOC tenants moving into our communities. As a result we have seen more mixing of incomes. At the same time, as a community at large, we are retaining higher income earners, which have the substantial disposable income to support essential retail that we all want to see in our communities: grocery stores, boutiques, restaurants and bars. Additionally, we have even seen employers respond to this trend by relocating their businesses to where their employees want to live. High income earners moving into an urban area can sound scary. But, the diversity of incomes not only supports these essential urban amenities but also helps to mix people of different races, ethnicities, sexual/gender orientation; to help build connections, build community and tear down the walls of structural racism that were the result of racist housing policies of government and banks which helped exacerbate racial segregation and all of the urban disinvestment along with it. Urban Disinvestment Round 2 Since the passing of the Housing Stability And Tenant Protection Act of 2019 (HSTPA), we have started to see the precursors of disinvestment. Collecting rent is the life blood of supplying housing of any kind. Rent collection is the biggest challenge in supplying housing to low and moderate income people. Tenants in this income segment tend to struggle with juggling and prioritizing paying bills due to income relative to their contract rent. A flat tire on their car can spell a financial crisis that can cascade into eviction. When the HSTPA passed, there was a marked change in the way tenant’s prioritized paying rent. Since the act gave them significant time to pay (almost 3 times as long), it jeopardized the sustainability of the landlords business. To be clear, the rent tenants pay is not pure profit. The landlord is a steward of that money and assumes the role of a private money manager. They take that rental income and pay all the bills associated with maintaining that property which include paying for utilities, real estate taxes, insurance, repairs and maintenance, property management fees, mortgage payments and also setting aside money for capital expenditures for future big ticket items (roof, HVAC, windows, etc.). After all those things are paid, the landlord hopefully takes a profit, but sometimes not. Once the regulations of the HSTPA were fully digested, some landlords that serviced low income residents started to sell their properties because their job became much harder and in many cases not economically viable. If that wasn’t enough, COVID 19 hit and those same landlords had to deal with an eviction moratorium that has gone on for almost two years. There are many of my colleagues who have been selling their properties and for the most part they have been getting bought up by out of town and even out of country investors, who have no connection to our community. Since they are disconnected by distance, they usually don’t maintain their properties as well (by routine maintenance standards or capital improvement standards). This phenomena is all well documented in city code enforcement. Furthermore, whatever profit they do make is extracted from our community and exported to wherever they live to support the economics of their community, not ours. In my experience these houses usually end of going to tax foreclosure and enter the revolving door of the foreclosure auctions until they become boarded up and vacant. At that point, the property usually needs more capital improvements than it is worth; becomes fully extracted. What is troubling about rent control is that it dicourages property owners from investing in their property. Under rent control, why would I buy a property that needs a new roof, new windows, new HVAC, new everything if I can only increase rents 3%. I cannot finance those capital improvements with debt or private investment while maintaining significantly below market rents. The only way I could potentially finance those improvements with keeping rents significantly the same, would be to buy the property for substantially less. Let’s run a scenario on a real property for illustration purposes. There is a 2 family property in the Beechwood neighborhood for sale where the asking price is $100,000. It features one apartment that is $650 a month and one that is $550 a month, so the annual gross income is $14,400. The annual operating expenses are $7200 a year and they include: real estate taxes (based upon an assessed value of $69,000), vacancy and collection loss, management fee, insurance, repairs and maintenance, utilities, etc. The house needs a new roof ($13,000), 2 new furnaces ($10,000), new windows ($7,000), and vinyl siding ($20,000) adding up to a total of $50,000 in needed capital improvements just to make the house safe to live in. This doesn’t include any interior cosmetic improvements needed. The inside is very much run down. I include three financial analyses below. The 1st scenario is if an investor bought the house and kept everything the same and did no improvements. 2nd scenario is if the investor bought the house, kept rents the same, but performed the necessary improvements. The 3rd is investor bought the house, increased rents up to market rates ($650 for the 1 bedroom and $850 for the 2 bedroom) and performed the necessary improvements. The analysis assumes the investor buys the house using conventional financing, putting 20% down, 30 mortgage, 3.571% interest. It also assumes no increase in real estate taxes. But we all know that the taxes will probably go up once the assessed value is brought up to what the investor paid for the property. If you review the chart above, you will see why so many investors (Extractors) in lower priced neighborhoods do not perform improvements on their properties, and they continue to deteriorate. And often times, these investors that do the bare minimum also have below market rents too, reference Clinton Lofts and many other recent housing atrocities as an example. So if Good Cause eviction is passed, the only way the investors can make a reasonable return on investment is if they buy the property and do nothing, or to buy the property for $50,000, half of the asking price. Which investor do you think will prevail in purchasing the property in an open market? The Extractor or the responsible property investor? And even if the responsible housing provider is able to purchase it for $50,000, it’s not necessarily good for the neighborhood in terms of building neighborhood home equity and supporting neighborhood stability.

Solutions To The Housing Affordability Crisis

This affordable housing crisis is real. But the responsibility for its cure cannot be borne by housing providers alone. These housing policies that have been enacted over the last several years further exacerbate the crisis. Here are some suggestions that will actually help alleviate this crisis. 1.) Expand and increase Section 8 housing voucher program. Solving income inequality will take generations to fix. But in the meantime, people need quality safe housing. Increasing the vouchers will give lift to the supply of quality naturally occurring affordable housing. If people have a larger budget to secure housing, that increase in demand will stimulate increase in supply and spur competition of responsible housing providers to compete for that business. The reason I have to keep my tenants happy is because they can choose where they want to live. If I fail them, they move. The only way I make money is by retaining tenants. Not churning and burning every year. The reason they have this choice is because they have the income to secure whatever housing they desire. Expanding Section 8 vouchers is also very important. People wait years to get on Section 8. In the meantime, their housing need persists. People shouldn’t have to wait years. 2.) De risk rent collection for Section 8 housing providers. The reason why many landlords discriminate against Section 8 is primarily due to payment risk. A section 8 housing voucher usually only covers a portion of the rent payment obligation. The landlord has to not only collect rent from Rochester Housing Authority (who administers the Section 8 voucher program) but also has to collect from the resident as well. This portion can be a substantial portion of the overall obligation. Solution: have tenants pay directly to Rochester Housing Authority and then they cut one check to the landlord. By RHA becoming the sole bursar of funds and guaranteeing 100% of the rent, it eliminates perceived payment risk. This would come with the responsibility of the landlord maintaining the housing with standards that would have to be maintained through the routine Section 8 housing inspection program. At the end of the day, landlords just want to do their job and get paid, period. So if you can eliminate that risk, you would attract more housing providers into the business of naturally occurring affordable housing. In the meantime, if the tenant falls behind on paying their portion to RHA, RHA can leverage their resources and networks to get their clients connected to the resources they need. 3.) Housing reactivation grants. According to the city of Rochester Building Blocks website, the city has 1,255 vacant residential structures of 1 unit or more. This is actual structures, not unit count. If a two-family home is vacant, it counts as one vacant structure. The city should offer developer fees, grants, or soft loans to small developers to reactivate vacant housing stock and convert it to affordable housing. HCR (Homes And Community Renewal) have a similar program where they incentivize larger developers to create affordable housing units and issue soft loans of $50k per unit to do so. The loan has a term of 15 years at 1% interest and is essentially forgiven after 15 years as long as the developer complies with keeping it affordable for the term. The city should pilot a program like this on a small scale and establish focused investment strategy areas located in marginal neighborhoods along main thoroughfares right on the edge of more stabilized areas. This would ensure long term affordability in bands that might be susceptible to resident displacement. The program could be used for rehabbing housing and selling to income eligible owner occupants as well. The city needs to partner with for profit housing providers in order to help meet demand. Low income housing tax credit affordable developers are an arrow in the quiver, not the magic bullet to solve all housing issues. Small for profit housing providers are more nimble and cost effective than the LIHTC developers. For example, Cedarwood Towers, a 206 unit apartment building was renovated in 2019. They utilized all of the tools at their disposal for affordable developers: Tax Exempt Bonds, Low-Income Housing Tax Credits, HUD, and LIPHRA. The cost? $41.6 million dollars, or over $200k per housing unit. And that was a renovation not a ground up new build. Ground up new builds cost over $300k per unit to build for affordable housing developers. A large portion of these inflated costs has primarily due to the soft costs associated with these developments and inflated hard costs associated with arduous compliance. Meanwhile, single family houses within a quarter mile radius or Cedar Towers are selling at a median price of $151,000 for a 1300 square foot, 3 bedroom, 1 bath house! A house! Not an apartment buried and siloed in some creepy high rise tower. Plus a private housing developer can reactivate vacant housing stock in less than one year. Affordable housing developers take years to create one housing project. So why don’t we pilot this program, establish a proof of concept, in order to create case studies to lobby HCR and other agencies to help create a streamlined program that can be more adequately scaled to our housing needs locally? 4.) Utilize Current Code Enforcement To Increase Housing Standards. This is the scalpel vs. hammer approach that should have been utilized a long time ago to root out slum lords. Instead recent housing policy changes have been made with good intentions but have punished everyone involved with the providing of housing for low to moderate income people. Code enforcement has been lax on enforcing better housing standards for existing housing. Therefore, there are properties that I visit and drive by every day that have fully unconditional certificates of occupancy which are ramshackle. I am not recommending that code enforcement go gestapo right now because there are many providers of affordable housing which have been completely decimated in the wake of the HSTPA and eviction moratorium. But code enforcement knows the usual suspects who don’t play by the rules and they need to be held to the same standards as everyone else. You see, the good people out there WANT to play by the rules and therefore seek authority in support of what their objective is... and then they get punished. For example, I pull building permits quite often and every time the process is a nightmare. The bad guys just do whatever the hell they want and barely get a slap on the wrist. Because in our environment currently, it’s easier to be bad.

0 Comments

|

AuthorThis blog serves an an outlet for all of our invaluable team members to share their insight on development, property management, and all things affecting real estate in our community. Archives

July 2023

Categories |

||||||||

RSS Feed

RSS Feed