Successful investors correctly and consistently find the upside in investment opportunities and that's what makes them successful, right? We always hear about how the savviest investors like Warren Buffett got into the right opportunity at the right time, and that's why he's a billionaire. You usually see the highlight reel, because that's what's sexy. What you never really hear about are the investments that he didn't make. Because that's not important, right? Wrong. Contrary to popular belief, the ability to understand risk is the single most important ability in investing and building wealth. Billionaire investor Warren Buffet, coined the following rules of investing: "Rule no. 1, never lose money, Rule No. 2, Don't forget rule number 1." It is far more important to understand the downside of an investment over the upside. For instance, consider Investment A that has a potential upside of 300%. And another Investment B that has an upside of 10%. You might be drawn to the A because of the upside. But what if I told you that A had a downside of 1000%, meaning you could lose more than your original investment and B had a downside of 5%. Every investment involves risk. You cannot make money without taking risk, so it is imperative for you to understand the risks involved with any financial investment decision before making one.

Today, we are going to cover liquidity risk, because liquidity risk is probably one of the single biggest risks involved with real estate investing. Liquidity risk is defined by Investopedia as follows: "Liquidity is how easily an asset or security can be bought or sold in the market, and converted to cash."  In other words, if you needed cash today you wouldn't be able to convert a real estate investment into cash very quickly at all, at least not for what the property is worth. It takes several months to sell a property and convert it to cash. This is one of the principal reasons why financial advisors shy their clients away from holding real estate assets. At the very most if you ask you advisor about owning some investment real estate, they will sell you shares in a real estate investment trust (REIT). That way, if you need cash today, you can sell those shares today. Yes, owning shares in a REIT gets you exposure to real estate... kind of. But it lacks a lot of the benefits of having direct ownership of real estate: control, tax benefits, higher cash flow (REITs on average produce 3.7% dividend yield according to Commercial Property Executive.), the list goes on an on, but I digress. Now, let's run this scenario. Call your financial advisor today and let them know you want to sell all of your stocks because you need the money. I will bet you they are going to ask "why" and will most likely put up a fight with you. They might say something like this: "These stocks are a long term investment. You don't want to sell them right now. This is a 10+ year hold." 10 year hold, eh? Weren't they just telling you to avoid real estate because of the liquidity risk? Which begs the question. If stocks (like real estate) are meant to be held for a long time, why aren't you being compensated for this liquidity risk? I am fine holding my investments for a long time. I just expect to be compensated for carrying that long term commitment and so should you! This is one of the primary reasons why I like this type of risk in real estate: because it's a manageable risk. If you allocate your assets properly and have plenty of cash and other marketable securities like stocks, you shouldn't ever have to sell your real estate in panic to meet short term obligations, aaaaaand you get paid for it. Bonus! Or at least should be paid for it. Make sure that when you invest in real estate, that you expect to earn more than average stock market returns. The second reason I actually like the illiquidity of real estate is that it forces you to be disciplined in long term holding and to best be positioned to capture the maximum upside. A brief story: I used to manage my own portfolio of individual stocks. I would research individual companies and buy ones that had strong fundamentals. I started buying Apple stock back in 2008 for $3.20 a share. I accumulated and added to that position for several years because I believed in the long term fundamentals of the company. I had conviction. However, the stock started skyrocketing during 2010 (it hit $13.60 a share), so I sold a little of my position. It would go up another 20% and I'd sell some. I kept doing this until 2015, until I was completely out of Apple. It was $27.63 a share. To my horror, I watched over the years, absolutely hating myself. Every time I bought a new iPhone, I would check the share price. If I just held on, or even forgot about my investment in the company, my $5,000 investment would have been worth $213,000! Mind you, this is not the only stock investment I have done this with. I just do not think I would ever have the discipline to hold onto a liquid asset like a stock and watch it go up 1000% and not be inclined to sell it. So What does this story have to do with real estate?  The point of the story is, if I would have had less liquidity, or if it was harder to sell my position in Apple or any other companies that I've owned, I would probably be a million dollars richer right now. With real estate, it takes a long time to even come to the decision to consider selling. Appreciation in Rochester, NY is pretty damn steady and nothing crazy happens with wild fluctuations in value. At the very most, if one of my properties has appreciated a bunch, I don't sell it; I refinance it, pull cash out and buy another investment property or two! Bottom Line: don't fear liquidity risk, embrace it and make it work for you!

0 Comments

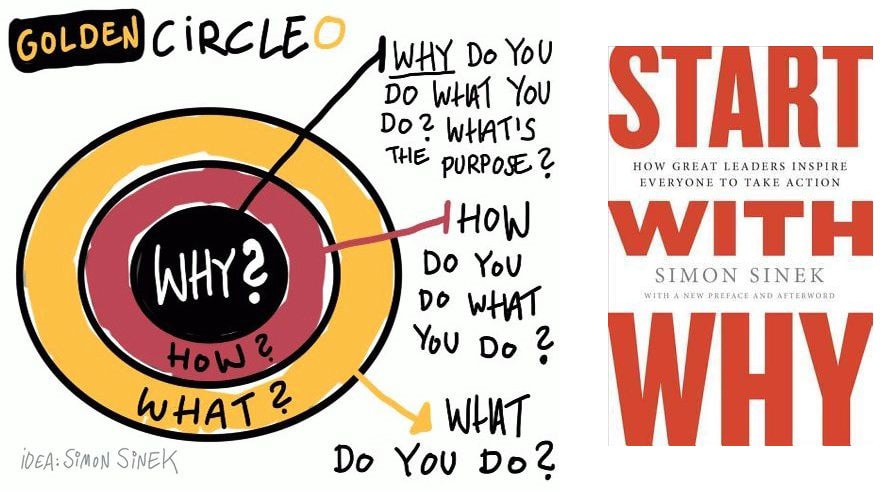

At the beginning of every new year, I get inundated with requests from friends and colleagues to "pick my brain" about becoming a real estate investor. Of course, I want to share all of the how to's of building wealth in real estate. I WANT to give back and help promote the use of this most effective tool in becoming more financially independent! I start off with any "brain picking" session by asking the person: "Why do you want to be a real estate investor?" I have to say that the most frequently heard answers to this question are as follows:

A typical investment property in a good location in Rochester, NY is usually going to run you anywhere between $100k to $200k. Thanks to our strong banking system, a lender will usually allow you to borrow between 75%-80% of the appraised value of your property! So to buy a decent property you will need to put down anywhere between $20,000 and $50,000 of cash. Lets assume you want to buy a $100k property for the purposes of this scenario...  The average cash return on investment real estate is anywhere between 8%-11%. So your average yearly cash on cash rate of return would be between $1600 - $2200 a year. If you are looking to make extra money, is $183 a month going to change your life? If you are struggling financially is $183 a month enough to lead you to salvation or financial nirvana? These are obviously rhetorical questions. And the answer is, unequivocally "no" based upon the reasons that were set forth for having an interest in the endeavor of investing in the first place. If this is your "why", I encourage you to find another way to make or (better yet) save $183 dollars a month. AND you can achieve this without parting from twenty thousand plus dollars. AND without having a property with tenants occupying your time or mental space. Eating out less, buying private label brands, purchasing commonly used house hold staples in bulk, trading in your car for a less expensive one. Print out all of your bank and credit card statements over that past 90 days and highlight all unnecessary purchases and you will quickly find several hundred dollars in savings. No $20k investment needed, no tenants, no brain damage. In regard to augmenting your income, there are a many ways to achieve that. Before you start selling essential oils, make up, vitamins, or protein shakes, start with your main occupation (sorry to my multi level marketing friends but I used to sell Amway, :-) so I have earned the right to make fun). Is it possible to earn overtime? If you work on commission, is it possible to hone your salesmanship skills and sell more of your company's product. I am a real estate sales person, I know there is always a better way to scale my company's revenue. Truth be told, I have invested more time in reading sales and personal development books than real estate books. If additional commission and overtime are off the table, perhaps you can find a way to perform your occupation better, identify ways to help your company perform better, i.e. make yourself more valuable. Employees who get promoted do so for going outside of their job description. They create more value than what they are paid. I all three of these are not options at your place of work or business, then figure out a side hustle based upon a unique skill or passion you have. For example, my brother Chris, loves vinyl records. He might actually be addicted haha. He turned that passion into income. He would troll craigslist and Facebook marketplace for vinyl record collections that were undervalued. He would purchase them and then run a weekly auction on Facebook live for a couple hours and rake in $300+ a week. This is just one example of monetizing a skill or passion. Again, all things that do not need $20k, don't involve tenants; no brain damage.  So now that I have thoroughly trashed a couple of reasons for investing in real estate, let's get to finding the right "why." Investing in real estate is AMAZING for building long term wealth. By long term, I mean 10 to 30 years. I was able to turn a $16,000 real estate investment and turn it into a property portfolio worth close to $9 million. BUT it only took me 15 years of consistent daily action. The reasons that I refuted above, were indicative of short term thinking. You have to get to deep personal reasons to establish a noble "why." Reasons that, if expressed publicly can make you feel vulnerable. I have an old investor client who started off with her "why" being the "extra money" thing. When I started asking more probing questions, it turned out that she wanted to use real estate as a way of funding her daughters college education. The reason this was so important to her was rooted in her immense financial struggle to obtain a college education for herself. She took on hundreds of thousands of dollars in student loans, tirelessly worked nights and weekends to pay for room and board, and ultimately wasn't going to be able to pay off her student loan debt until her late forties. She did not want her daughter to go through the same struggle she did. So we tailored a plan for her to find an investment property in alignment with her "why." I ended up finding her a property for $200k. She put $50k down, and we found a lender that would put an 18 year mortgage on it, so that by the time her daughter turned 18, she could sell or refinance the property and have college paid for. If you want to invest in real estate, start with "why" first! Our 2021 commitment, inclusive partnership opportunities, to allow you to own a peice of the ROC!1/4/2021

Upon David Martin and my professional journey, we have come to realize that the reason the participation of these projects remain in the hands of the very few is due to HIGH barriers of entry. It takes a lot of money and experience. For us it has taken decades of experience and to forge the relationships with the people who make our projects happen: our investment partners. Who happen to all be high net worth individuals. People who can spare anywhere from one hundred thousand to half a million dollars to partner with us on our projects. To see some examples of some of our recent completed projects click here.

We realize that this system is extremely exclusive. Our company OakGrove Companies seeks to be more inclusive with all parts of our company, but have not been inclusive on the curation of our investment partner base. The reasons for this are simple. Having a hundred small investment partners on a project instead of one large investor is very cost prohibitive. The cost of compliance, financial reporting, and just the simple logistics of having to communicate with a hundred partners as opposed to one. Crowdfunding technology and securities law reform over the past 10 years has been a game changer and will allow us to be way more inclusive to our partner base. So that being said, our New Years resolution in 2021 is to widen our audience of potential partners! So if you are interested in receiving information on our upcoming development opportunities, please request to subscribe to OakGrove Capital's upcoming investment offerings here! Cheers and Happy 2021! |

AuthorThis blog serves an an outlet for all of our invaluable team members to share their insight on development, property management, and all things affecting real estate in our community. Archives

July 2023

Categories |

RSS Feed

RSS Feed