At the beginning of every new year, I get inundated with requests from friends and colleagues to "pick my brain" about becoming a real estate investor. Of course, I want to share all of the how to's of building wealth in real estate. I WANT to give back and help promote the use of this most effective tool in becoming more financially independent! I start off with any "brain picking" session by asking the person: "Why do you want to be a real estate investor?" I have to say that the most frequently heard answers to this question are as follows:

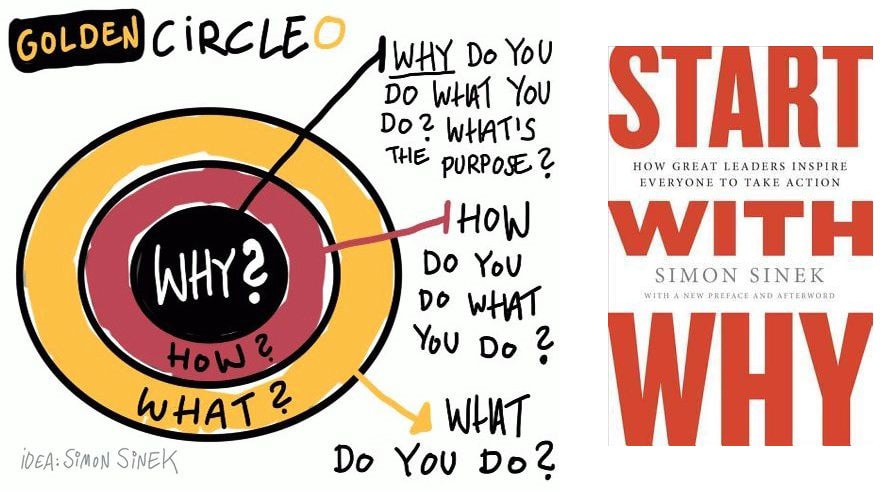

A typical investment property in a good location in Rochester, NY is usually going to run you anywhere between $100k to $200k. Thanks to our strong banking system, a lender will usually allow you to borrow between 75%-80% of the appraised value of your property! So to buy a decent property you will need to put down anywhere between $20,000 and $50,000 of cash. Lets assume you want to buy a $100k property for the purposes of this scenario...  The average cash return on investment real estate is anywhere between 8%-11%. So your average yearly cash on cash rate of return would be between $1600 - $2200 a year. If you are looking to make extra money, is $183 a month going to change your life? If you are struggling financially is $183 a month enough to lead you to salvation or financial nirvana? These are obviously rhetorical questions. And the answer is, unequivocally "no" based upon the reasons that were set forth for having an interest in the endeavor of investing in the first place. If this is your "why", I encourage you to find another way to make or (better yet) save $183 dollars a month. AND you can achieve this without parting from twenty thousand plus dollars. AND without having a property with tenants occupying your time or mental space. Eating out less, buying private label brands, purchasing commonly used house hold staples in bulk, trading in your car for a less expensive one. Print out all of your bank and credit card statements over that past 90 days and highlight all unnecessary purchases and you will quickly find several hundred dollars in savings. No $20k investment needed, no tenants, no brain damage. In regard to augmenting your income, there are a many ways to achieve that. Before you start selling essential oils, make up, vitamins, or protein shakes, start with your main occupation (sorry to my multi level marketing friends but I used to sell Amway, :-) so I have earned the right to make fun). Is it possible to earn overtime? If you work on commission, is it possible to hone your salesmanship skills and sell more of your company's product. I am a real estate sales person, I know there is always a better way to scale my company's revenue. Truth be told, I have invested more time in reading sales and personal development books than real estate books. If additional commission and overtime are off the table, perhaps you can find a way to perform your occupation better, identify ways to help your company perform better, i.e. make yourself more valuable. Employees who get promoted do so for going outside of their job description. They create more value than what they are paid. I all three of these are not options at your place of work or business, then figure out a side hustle based upon a unique skill or passion you have. For example, my brother Chris, loves vinyl records. He might actually be addicted haha. He turned that passion into income. He would troll craigslist and Facebook marketplace for vinyl record collections that were undervalued. He would purchase them and then run a weekly auction on Facebook live for a couple hours and rake in $300+ a week. This is just one example of monetizing a skill or passion. Again, all things that do not need $20k, don't involve tenants; no brain damage.  So now that I have thoroughly trashed a couple of reasons for investing in real estate, let's get to finding the right "why." Investing in real estate is AMAZING for building long term wealth. By long term, I mean 10 to 30 years. I was able to turn a $16,000 real estate investment and turn it into a property portfolio worth close to $9 million. BUT it only took me 15 years of consistent daily action. The reasons that I refuted above, were indicative of short term thinking. You have to get to deep personal reasons to establish a noble "why." Reasons that, if expressed publicly can make you feel vulnerable. I have an old investor client who started off with her "why" being the "extra money" thing. When I started asking more probing questions, it turned out that she wanted to use real estate as a way of funding her daughters college education. The reason this was so important to her was rooted in her immense financial struggle to obtain a college education for herself. She took on hundreds of thousands of dollars in student loans, tirelessly worked nights and weekends to pay for room and board, and ultimately wasn't going to be able to pay off her student loan debt until her late forties. She did not want her daughter to go through the same struggle she did. So we tailored a plan for her to find an investment property in alignment with her "why." I ended up finding her a property for $200k. She put $50k down, and we found a lender that would put an 18 year mortgage on it, so that by the time her daughter turned 18, she could sell or refinance the property and have college paid for. If you want to invest in real estate, start with "why" first!

0 Comments

Leave a Reply. |

AuthorThis blog serves an an outlet for all of our invaluable team members to share their insight on development, property management, and all things affecting real estate in our community. Archives

July 2023

Categories |

RSS Feed

RSS Feed