|

Short term rentals (Airbnb and VRBO) are the new hotness in the real estate investing world. EVERYONE is talking about them. If you are interested in buying a property to convert into a short term rental, I have some advice:

1.) In my opinion, Short Term Rentals (STR) is not real estate investing in the conventional sense. It’s the hospitality business. There’s nothing passive about it. Just like flipping houses isn’t passive income. It’s another J O B. (I was an Airbnb host, and the last straw for me was when I got a bad review because I forgot to refill a salt shaker 😱, so I converted the unit back to a long term yearly rental). However, the business does have scale. So if you plan on owning one STR, it’s easier to own ten. So if your ambition is to own one and only one, don’t waste your time. However if you want to try one out, and you like it, plan on acquiring more. 2.) There is a high degree of regulation risk. A municipality can put you out of business with the stroke of a pen. As Airbnb’s get more popular, popping up everywhere, it only takes a few instances of some wild bachelor parties or pop up brothels (this has happened to hosts I know) for a town to crack down and before you know it, your listing will disappear off of the STR platforms. So make sure you run your numbers as if it was a long term rental and make sure the numbers work in the event that this happened. 3.) In terms of location, this is even more important than long term rentals. Make sure you are starting in a location that is desirable to travelers. The log cabin out in the middle of nowhere might be appealing for a writers retreat or Instagram photos but it lacks mass appeal to keep bookings high and not succumb to hyper seasonal demand. Choose a location that is either well traveled by leisure or business travelers and has attractions and amenities that are appealing to out of towners. For instance, the first Airbnb I owned was walking distance to museums, restaurants, bars, and parks as well as being close to hospitals and universities. We were consistently booked throughout every month. Hope this helps!

4 Comments

There was a post this week on a real estate forum I follow. It is an investor who owns 4 investment properties free and clear (no mortgage) and wants to scale into larger multifamily deals but has no cash; all of their capital is locked into properties they have rented out. A link to the original post is on BiggerPockets, a social media platform for real estate investors. If you haven't done so already, check it out, create a profile and subscribe to their podcasts. There's a wealth of free information on there. The link to the post is here:

www.biggerpockets.com/forums/12-starting-out/topics/979053-4-properties-and-no-cash-now-what "Bryce, I've been in your shoes. The challenge of the typical real estate investor is that you are always running out of money. Asset rich, but cash poor to grow your real estate business. A couple of options for you here: 1.) You can cash out refinance and hold the cash out proceeds on your books until you find a larger deal you want to purchase. Yes, you are paying interest on utilized cash but it's good to have dry powder when you're ready to pull the trigger on something. If you don't do this... I always say "opportunity never comes at a convenient time." I guarantee you, when you find your perfect larger multifamily or commercial deal, you are going to be scrambling to refinance your three properties, and the opportunity will slip through your fingers. 2.) Find a deal with a seller who will allow you to put their property under contract contingent upon you selling your property or properties and doing a 1031 Exchange. Problem with this, is that not all sellers will be comfortable with this type of contingency or a contingency like this will render you uncompetitive. 3.) Do a cash out refi with a hard money lender, and use the cash out proceeds as a down payment on your larger deal. This would enable you the flexibility of getting your down payment money quickly but cost you in terms of higher interest rates. Most hard money lenders will charge between 8-16% interest effectively; much higher than the banks. Then refinance the hard money mortgage with conventional permanent financing with a bank. Or if the larger deal you are buying has enough meat on the bone from a value add standpoint, you can force the apprecation by stabilizing expenses, pushing rents after performing improvements, and then refinance your new deal and pay off the hard money loans on your condos. This scenario would require you to walk the knife a bit and add a lot of moving parts or variables which you might not be comfortable with. 4.) Raise the downpayment money for your larger deal from people who have cash. In one of our recent blog posts (which is here), we covered that in this low interest environment there is a big problem out there. People with cash don't know what to do with it in order to earn a higher return without taking unnecessary risk. We partner with these types of investors and pay them 8% on their money, which is much higher than their bank or bonds or any other safer fixed income instrument out there. We use this capital to purchase and improve property and then pay them back once we've executed our value add strategy for the property. Once we've significantly improved the property's net operating income (NOI), we take it back to our bank and they give us a higher loan amount which allows us to pay our investors back. (If you, the reader, are interested in learning more about our opportunities, get on our OakGrove Capital distribution list HERE) If I were you, I would go with option 1. With rates as low as they are right now, you are essentially shorting the dollar. If you needed a place for the cash for a year or so, perhaps you could be a hard money lender yourself and make some money on the spread until you are ready to purchase something larger. I hope this helps! Congrats on being a stay at home parent. Being a good and present family person was my top reason for earning my financial freedom. I was able to accomplish that by scaling into larger deals. From a real estate investors perspective (or any investor's perspective) for that matter, things are pretty weird out there! Over the last two years we have not been able to find any opportunities that match our traditional investment criteria. What we have made an investing career out of is buying stabilized value add commercial and multi family property. Stabilized means that the investment property you are buying is not distressed. Think low occupancy sub 80% occupancy or significant deferred maintenance or both. The reason we have focused on this type of asset class is because:

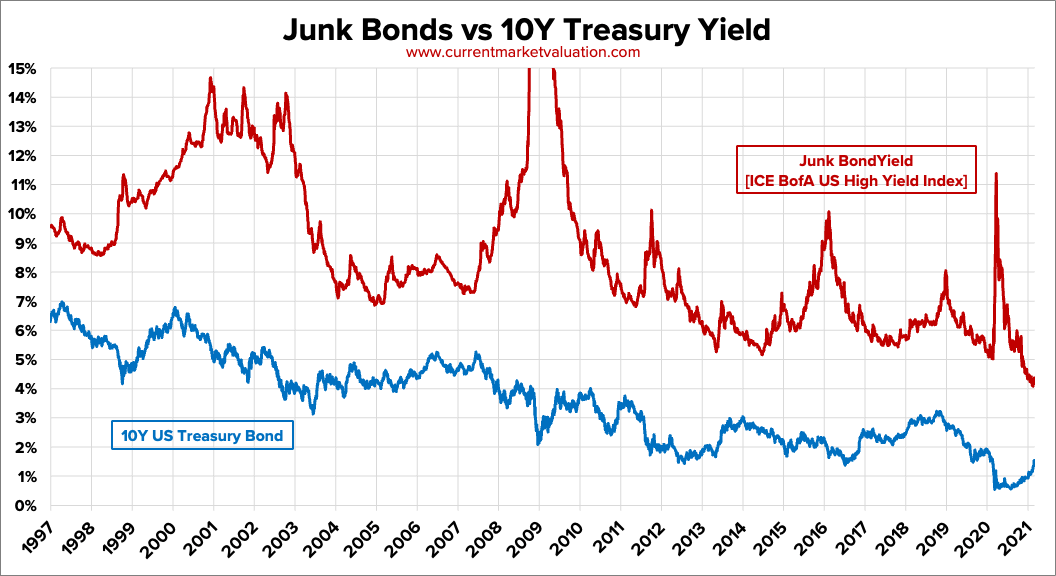

When prices go up, the market starts to get riskier in our eyes. We are value investors who take risk management as our #1 responsibility and the reason we like real estate is because it's low risk... if you buy right. Next, I will explain a very reliable measure of risk that concerns us right now. Above is chart of the historical interest rates of junk bonds versus 10 year treasury bonds. Junk bonds are debt issued by companies that are what is termed "non investment grade." These companies have some type of financial issues that make them riskier than their peers and therefore need to offer a higher yield than companies with investment grade status as rated by agencies like Moody's and Standard & Poor's. 10 Year Government bonds are considered having zero default risk and their historical yields are featured on the blue trend line above. Junk bonds rates usually average around a 9% annualized yield. They are now trading at 4%, less than half the historical average! This is a clear indication that there is a lot of money out there and it is chasing, nay starving for yield. So all that excess cash has been flooding the real estate markets and alternative asset classes of all types. So what have we been doing at OakGrove Development? Well over the past two years we have found a real estate niche that no one is chasing: vacant commercial buildings in the path of growth that we can purchase at a significant discount to replacement cost. When you buy a vacant building, there are significant risks involved. These include lease up risk and construction risk. Lease up risk is the risk that you won't be able to find tenants for your property. This is a very inherent risk in office, retail, and industrial type asset classes. If you cannot find tenants, carrying costs can quickly get out of hand and defeat the purpose of owning investment real estate, which is CASH FLOW. Construction risk is even if you do find a tenant for vacant space in the building, you will probably have to build it out for them. Sometimes these build outs can be quite expensive and lengthy, and if you have cost overruns your project might become upside down very quickly (putting more capital into a building than what it is worth.) Plus, vacant buildings are hard to finance. Banks won't touch them if you do not have tenants in hand. Therefore it eliminates a lot of competition from most investors who depend upon bank financing to buy most of their deals. So how do we mitigate these risks?

2.) We have been buying properties in areas that are in the path of growth or progress. In other words we have buying properties that are located adjacent to very large catalytic projects which will bring a huge influx of capital and therefore people. For example, 17 East Main Street is located right next to the $28 million dollar redevelopment project known as The Aqueduct District, a mixed use redevelopment project being undertaken by Landers Communities and billionaire Rob Sands of Constellation Brands. The project will feature over 120 new apartment homes as well as restaurants, a yoga studio, and Co-living micro studios done in partnership with Common, a national co-living brand. Among many other smaller private redevelopment projects in the pipeline there is also the $500 million ROC The Riverway project whose locus is right around where the subject property is. When we invest in projects in the path of growth, our buildings can benefit from the halo effect of these larger projects and we can ride on their coattails, so to speak. We prefer to be market takers not market makers. As real estate author David Lindahl said: Don't be a pioneer. Pioneers are the ones that wind up face down in the mud with arrows in their back! I hope you find this helpful and interesting! If you would like to talk shop on real estate investment contact us anytime! If you would like to join our private lenders network, please join our distribution list below! We pay 8% interest to our lenders on two to five year terms, with payments made monthly via ACH. Our lenders are secured by real estate and backed personally by myself and partner David Martin.

|

AuthorThis blog serves an an outlet for all of our invaluable team members to share their insight on development, property management, and all things affecting real estate in our community. Archives

July 2023

Categories |

RSS Feed

RSS Feed