|

From a real estate investors perspective (or any investor's perspective) for that matter, things are pretty weird out there! Over the last two years we have not been able to find any opportunities that match our traditional investment criteria. What we have made an investing career out of is buying stabilized value add commercial and multi family property. Stabilized means that the investment property you are buying is not distressed. Think low occupancy sub 80% occupancy or significant deferred maintenance or both. The reason we have focused on this type of asset class is because:

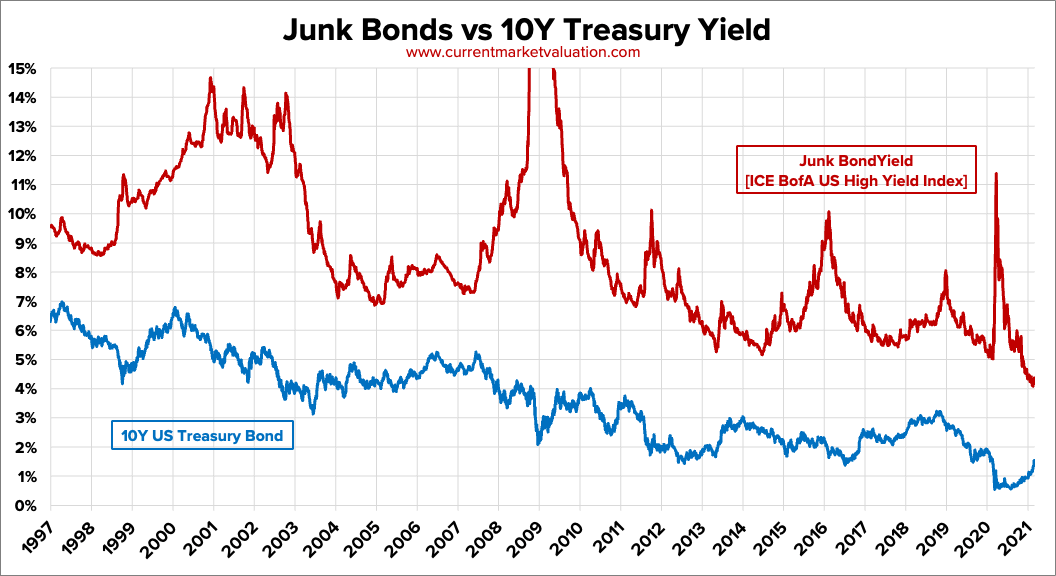

When prices go up, the market starts to get riskier in our eyes. We are value investors who take risk management as our #1 responsibility and the reason we like real estate is because it's low risk... if you buy right. Next, I will explain a very reliable measure of risk that concerns us right now. Above is chart of the historical interest rates of junk bonds versus 10 year treasury bonds. Junk bonds are debt issued by companies that are what is termed "non investment grade." These companies have some type of financial issues that make them riskier than their peers and therefore need to offer a higher yield than companies with investment grade status as rated by agencies like Moody's and Standard & Poor's. 10 Year Government bonds are considered having zero default risk and their historical yields are featured on the blue trend line above. Junk bonds rates usually average around a 9% annualized yield. They are now trading at 4%, less than half the historical average! This is a clear indication that there is a lot of money out there and it is chasing, nay starving for yield. So all that excess cash has been flooding the real estate markets and alternative asset classes of all types. So what have we been doing at OakGrove Development? Well over the past two years we have found a real estate niche that no one is chasing: vacant commercial buildings in the path of growth that we can purchase at a significant discount to replacement cost. When you buy a vacant building, there are significant risks involved. These include lease up risk and construction risk. Lease up risk is the risk that you won't be able to find tenants for your property. This is a very inherent risk in office, retail, and industrial type asset classes. If you cannot find tenants, carrying costs can quickly get out of hand and defeat the purpose of owning investment real estate, which is CASH FLOW. Construction risk is even if you do find a tenant for vacant space in the building, you will probably have to build it out for them. Sometimes these build outs can be quite expensive and lengthy, and if you have cost overruns your project might become upside down very quickly (putting more capital into a building than what it is worth.) Plus, vacant buildings are hard to finance. Banks won't touch them if you do not have tenants in hand. Therefore it eliminates a lot of competition from most investors who depend upon bank financing to buy most of their deals. So how do we mitigate these risks?

2.) We have been buying properties in areas that are in the path of growth or progress. In other words we have buying properties that are located adjacent to very large catalytic projects which will bring a huge influx of capital and therefore people. For example, 17 East Main Street is located right next to the $28 million dollar redevelopment project known as The Aqueduct District, a mixed use redevelopment project being undertaken by Landers Communities and billionaire Rob Sands of Constellation Brands. The project will feature over 120 new apartment homes as well as restaurants, a yoga studio, and Co-living micro studios done in partnership with Common, a national co-living brand. Among many other smaller private redevelopment projects in the pipeline there is also the $500 million ROC The Riverway project whose locus is right around where the subject property is. When we invest in projects in the path of growth, our buildings can benefit from the halo effect of these larger projects and we can ride on their coattails, so to speak. We prefer to be market takers not market makers. As real estate author David Lindahl said: Don't be a pioneer. Pioneers are the ones that wind up face down in the mud with arrows in their back! I hope you find this helpful and interesting! If you would like to talk shop on real estate investment contact us anytime! If you would like to join our private lenders network, please join our distribution list below! We pay 8% interest to our lenders on two to five year terms, with payments made monthly via ACH. Our lenders are secured by real estate and backed personally by myself and partner David Martin.

0 Comments

Leave a Reply. |

AuthorThis blog serves an an outlet for all of our invaluable team members to share their insight on development, property management, and all things affecting real estate in our community. Archives

July 2023

Categories |

RSS Feed

RSS Feed