|

For all of the years that I have been trying to read a crystal ball and make predictions about economics, I have to admit that I have been wrong every single time. When predicting, you have to understand that you too, will always be wrong. The objective is not to be right (because that is impossible), but to be less wrong. The Federal Reserve bank has made one thing remarkably clear. They are going to get this inflation thing under control and back to it's target of 2% at ALL COSTS. Jerome Powell, Chair Of The Fed has basically said that the reserve bank is going to ignore its dual mandate of balancing inflation and unemployment and focus solely on its inflation target. Our opinion is that the Fed will overshoot its quantitative tightening policy and the recession will be led by a drop in consumer confidence and thus consumer spending. Below, I feature some stats on why we believe that will happen:

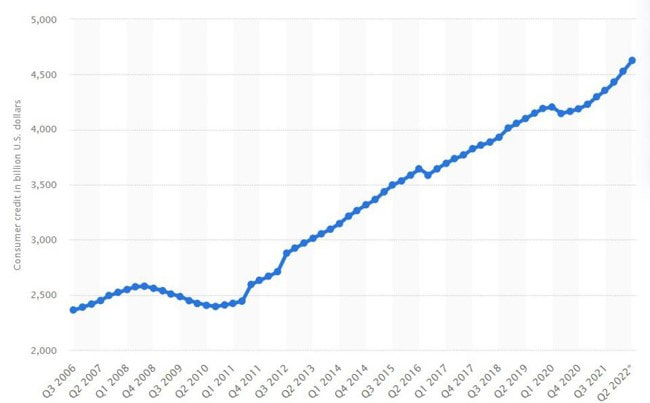

Personal savings rate betweeen 2013 and 2019 was in a range between 5.6% and 9.5%, usually bouncing around 7%. From the beginning of this year the savings rate has dropped from 4.7% down to 3.5%. More consumers have less and less left over due to the very high prices for everyday goods. And recent studies have shown that the reported drop in consumer confidence hasn't translated into their actual spending patterns. Consumer credit has ramped up rather quickly even as the cost of everyday goods and services is starkly higher while incomes have failed to keep up. Most of this consumer credit is tied to interest rates that will go up as the Fed hikes rates. Below is a chart showing consumer credit in billions of dollars. As you can see, that despite the rampant inflation that consumers have endured over the past year, the average consumer has been dipping into unsecured credit lines rather than cutting back their household spending...

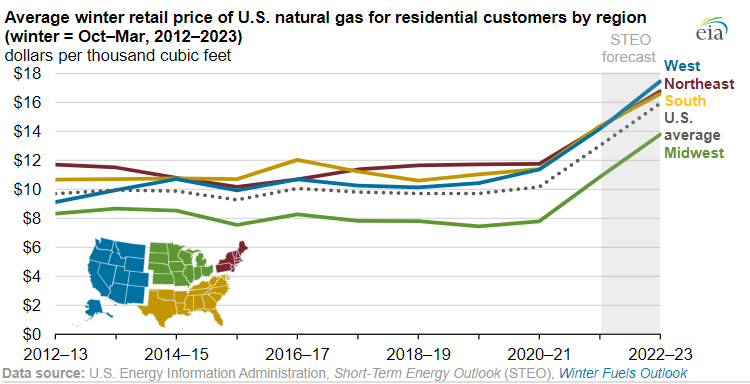

The one element no one is seeming to talking about is the effect of natural gas prices on consumers this winter. The US Energy Information Administration expect that the average resident that heats their home with natural gas will see their heating bill go up 28% this home heating season. Nothing makes people feel like they are more poor than higher energy costs. We believe this will have the effect on sapping consumer confidence needed to bring spending under control and to start having households institute their own belt tightening austerity measures. Banks are already starting to manage risk by padding themselves for anticipated loan losses. As "risk free" assets like US treasuries yields spike, you will start to see financial institutions take a flight to safety and away from risky consumer credit. You've already seen a lot more advertisements about CD rates and less ads for consumer credit products.

Below is a chart from the US Energy Information Administration on their projections of natural gas prices. (the full article in link below) https://www.eia.gov/todayinenergy/detail.php?id=54259#:~:text=On%20average%2C%20we%20expect%20retail,winter%2C%20to%20%2413.80%2FMcf. The Bottom Line

The real estate investment industry is very interest rate sensitive. Because of the volatility in the bond markets most of our banking partners are not offering interest rate locks until closing. Traditionally we have been able to lock interest rates at loan application or issuance of commitment letter. We are seeing local banks in Rochester, NY quoting rates between 7% and 8%. Normally real estate investment opportunities priced between a 7% and 8% capitalization rate have been attractive but only attractive in a 4% and 5% interest rate environment, unless there is some clearly definable path to significant low risk upside in net operating income.

Regardless, we are still buyers in this market but risk management is king. Real estate deals we are looking at have to be quality assets in great locations AND with significant upside. It certainly is a breath of fresh air to finally be looking at opportunities that aren't bloodbaths of competition with other buyers. We are certain that the days of 3% to 4% debt are over but we don't think that 8%+ debt is permanent. So we are currently locking in debt for 5 years with hopes that rates will normalize more towards 5% to 7%. Remember, focus on acquiring great real estate. Desirable real estate. Low interest rates don't make a bad deal good. If the deal cash flows from day one and there is upside potential, you can always refinance or put a supplemental loan on the deal after you increase it's value. The determinant of that decision being rates in the next 3 to 5 years. Our words of advice, "Marry the property, date the rates." If you think our commentary helped you with some valuable insights, please consider subscribing to our newsletter. As always, if you want to hear about a topic concerning real estate, please leave them in the comments below!

0 Comments

Leave a Reply. |

AuthorThis blog serves an an outlet for all of our invaluable team members to share their insight on development, property management, and all things affecting real estate in our community. Archives

July 2023

Categories |

RSS Feed

RSS Feed