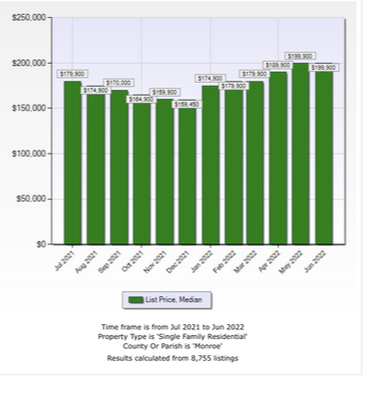

What all of this means is that it costs home buyers over $400 more per month to buy the same house as last year. In addition to that, EVERYTHING is more expensive! Food, energy, cars, healthcare, child care, etc. This definitely has an effect on buyer's purchasing power and also general confidence. With that being said, the supply demand balance still remains strongly in favor of home sellers. The market is not being flooded with inventory. In fact, the opposite is true, the amount of single family homes in Monroe for sale in June 2022 was 439, down 12% from the previous year. This loss in supply has counteracted loss of demand from buyers that may have resulted from the aforementioned information. The reason why price reductions are up significantly is not because, demand is falling. It is because many seller's have succumbed to pricing strategy that is misaligned with this rapidly changed interest rate environment. As Americans, we are not a "what's the price?" culture, we are a "what's my monthly payment?" culture. So if the same house costs you $400 a month more to own over one year, you bet it's going to affect the market. The biggest mistake I see sellers making is looking at recently closed sales comparables as a basis to come up with their asking price. They are making the mistake of using old data. Think about it. If a sales comparable closed three months ago, that means the person who bought that house actually purchased it 6 months ago, because it generally takes 60-90 days to close a real estate transaction in Monroe county. That means that particular buyer bought that sales comp when interest rates were 3%, not 6%! The biggest mistake you can make as a home seller is to over price your house. When you over price, buyers won't make offers and you will soon be reducing the price. When selling your home, time is not on your side. Usually, the longer your house sits, the more likely it will actually end up selling less than if you priced it right to begin with! So, how should you price if sales comparables are based upon irrelevant data? The simple answer is ask your real estate professional!!! But if you are looking for quick and dirty advice, it's better to under price than over price. I tell our clients, price is nothing more than a marketing tool. You want to price your home so that it get's prospective buyers "in the door." If the sales comps are suggesting a median price of $240k, price the property at $199k. If the sales comps are suggesting a median price of $375k, price the property at $349k. If it's a difficult property to compare with recent sales, price it even lower. We've all seen "white elephant" properties or ones that don't fit the character or what's typical for the area. It's better to err on the side of caution. At the end of the day, the market will find the price for your property, not you.

1 Comment

Martin

7/5/2022 10:31:49 am

Excellent analysis. Thank you.

Reply

Leave a Reply. |

AuthorThis blog serves an an outlet for all of our invaluable team members to share their insight on development, property management, and all things affecting real estate in our community. Archives

July 2023

Categories |

RSS Feed

RSS Feed