|

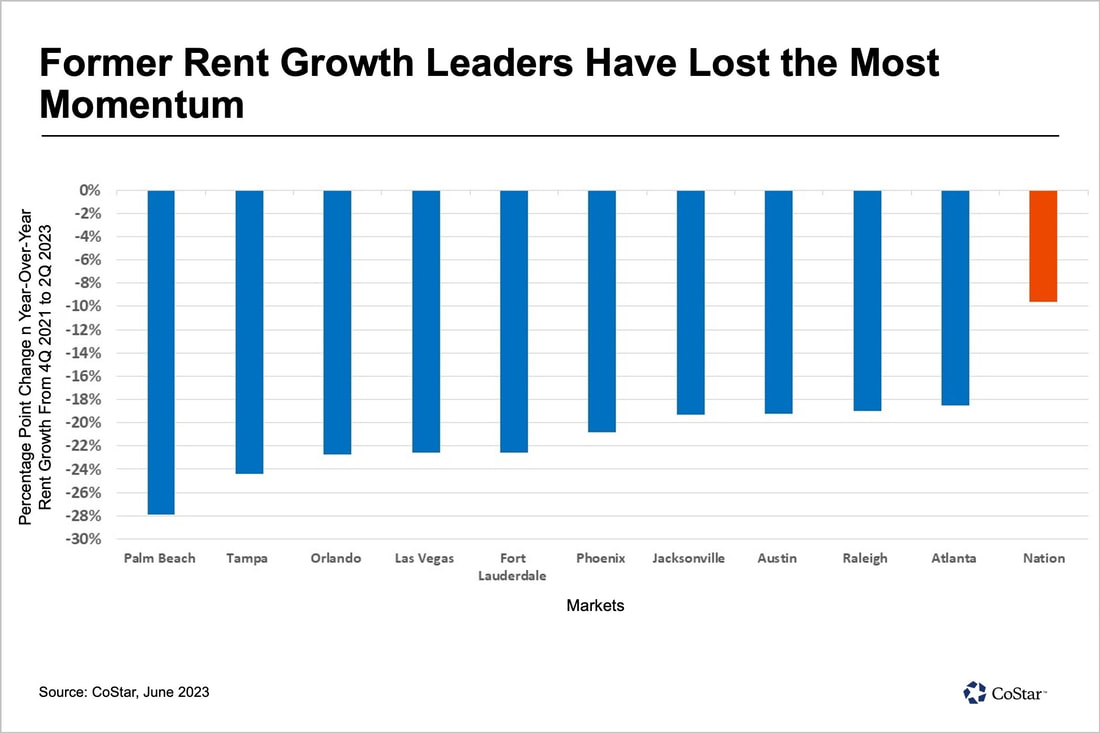

Don't let the headlines fool you on the fundamentals of your own market. The most recent multifamily reports that you'll see is a significant pull back in rent growth, even some recently high flying markets have had negative rent growth, like Tampa, Phoenix, Austin, and Atlanta, some as high as a negative rent growth of 24% from 4th Quarter 2021 to 2nd Quarter 2023!

The pull back in these markets is due to a confluence of many factors, but it started with these environmental factors:

For these markets, the last 5 years have been a seemingly never ending party! But now, they are dealing with a hangover. But not Rochester, NY! We've maintained our status as the "steady eddy" of real estate. In a nut shell, rent growth has remained elevated but not sky high. So the low interest rate environment dovetailed with "good but not great" demand has kept new inventory low and absorption of any new product very healthy.

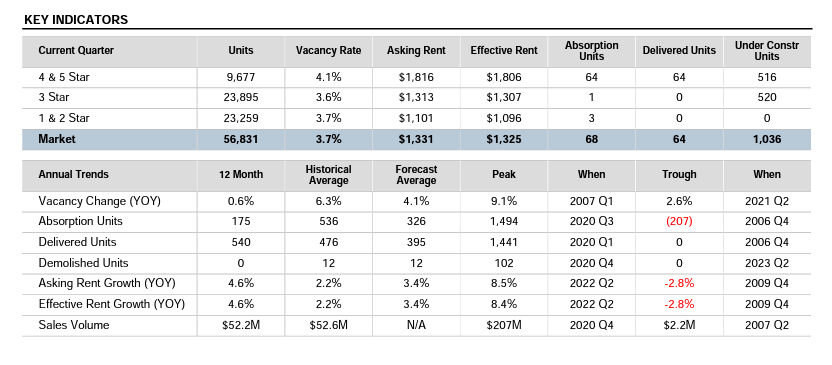

Turns out Rochester is not the only market in the US that has not fallen victim to the headline numbers. "Midwest and Northeast markets remain the most stable given their more modest construction pipelines and are projected to see rent growth in the 2% to 3% range into 2024." As a region, our relatively anemic rent growth and job growth has prevented developers from appreciably adding to new supply of multifamily housing. According to Costar (a real estate analytics firm): "Vacancy in the Rochester multi-family market is 3.7% and has increased by 0.6% over the past 12 months. During this period, 540 units have delivered, and 180 units have been absorbed.... Rents are around $1,330/month, which is a 4.6% increase from where they were a year ago.... About 1,000 units are under construction, representing a 1.8% expansion of inventory. There have been 22 sales over the past year. Sales have averaged $85,330/unit.... Over the past three years, there have been 122 sales, which have traded for approximately $277 million. The market cap rate for Rochester is 7.1%, slightly above its trailing three-year average of 6.9%...." However, sales transaction volume is down considerably. This is primarily due to high interest rates and a very wide bid-ask spread between what sellers want for their property (the ask) and what buyers can conceivably pay (the bid) while being able to meet their return requirements for their lenders and investors. We've seen it first hand. Not only do we have to pay a lower price for a property, just to meet the Debt Service Coverage Ratio our banks require, but also we need to be more competitive in the annual returns that we offer our investment partners. Just a few years ago, it was easy to raise capital for deals while offering a 7% fixed annual rate of return to our investors when 10 year treasuries were paying 0.55% to investors. Now 10 year treasuries are paying closer to 4% and FDIC insured money market accounts are paying 5%. All of these factors have to be considered when calculating the net present value on any asset we purchase. However, property owners haven't come back down to reality, because they don't HAVE to sell. So it's resulting in sales volume of multifamily assets plummeting to almost 50% of the 5 year average. According to Costar: "Rochester recorded just 22 market-rate trades over the past 12 months, which was near the bottom of its peer group. That translated to the lowest number of sales over a 12-month period in five years, as investors appeared to dial back purchasing activity. Annual sales volume has averaged $101 million over the past five years, and the 12-month high in investment volume hit $207 million over that stretch. In the past 12 months specifically, $51.9 million worth of multifamily assets sold."

We own a fair amount of multifamily in the Rochester market. So are these statistics mirroring what we are seeing across our assets?

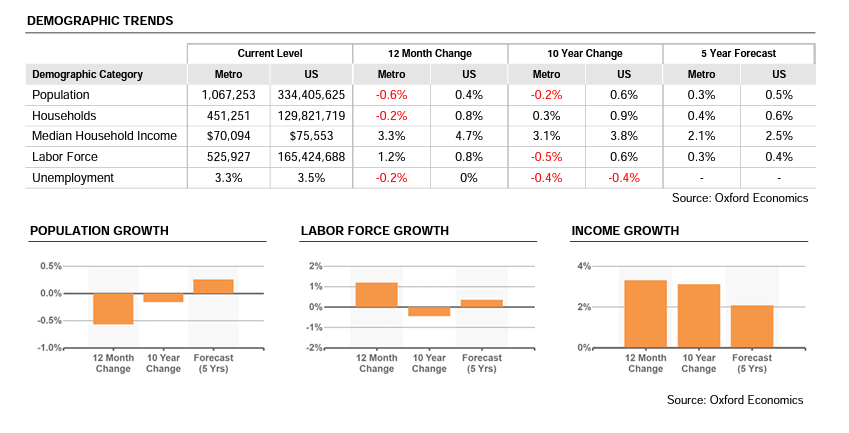

The short answer is "yes" As a company, we've been able to maintain strong occupancy at 97% while achieving organic rent increases of 5.2% across our residential portfolio over the the past 12 months and been able to achieve rent increases on average of 5% while maintaining occupancy of 97% for the year prior to that as well in 2021. In regard to the new acquisitions, our experience has been consistent with the stats as well. Many more opportunities are coming our way through commercial real estate brokers and our work on off market deals direct to seller, but the pricing expectations are not in line with the reality of interest rates and our investment return requirements given the current state of what our investment partners are now demanding given how high returns have been driven in "risk free" assets like MMA (Money Market Accounts) and other fixed income products. This has been primarily the result of the Federal Reserve's monetary policy to help curb inflation. So that's a snap shot of local multifamily. What about the local economic fundamentals in Rochester? As you will see, the underlying fundamentals in our region remain steady. Although there are no foreseeable catalysts in turbocharging household incomes or population growth, there are no foreseeable cataclysmic events that should shake that up. Rochester has gone through it's changes. We no longer have the corporate behemoths of Kodak, Bausch And Lomb, or Xerox. But out of their ashes, we've risen, possessing a diversified economy of a constellation of companies largely made up of recession resistant sectors like education and healthcare. Some key stats:

If you are a multifamily investor, be patient. It's going to take some time for bid ask spreads to narrow and create buying opportunities for operators. As inventory starts to tick up, and deals start to stay on the market for longer, some sellers will come to grips with reality. That being said, now is the time to keep prospecting for opportunities and maintain top of mind in your sector as an active buyer. If you own small multifamily 2-4 unit, the market is still red hot. We are jumping on the opportunity and strategically selling off some of our smaller assets that have considerably appreciated in value. We are not a fan of doing 1031 Exchanges right now because of the constrained market on the buy side. Instead we are selling some assets and then performing a cost segregation analysis on some of our larger deals to help defray or eliminate capital gains taxes, and just sticking the cash on our balance sheet to better position ourselves for a potential market shift. Did you find this article interesting or helpful? Would you like to be made aware of future blog posts and industry events? If yes, please subscribe to our newsletter!

0 Comments

Leave a Reply. |

AuthorThis blog serves an an outlet for all of our invaluable team members to share their insight on development, property management, and all things affecting real estate in our community. Archives

July 2023

Categories |

RSS Feed

RSS Feed