|

Short term rentals (Airbnb and VRBO) are the new hotness in the real estate investing world. EVERYONE is talking about them. If you are interested in buying a property to convert into a short term rental, I have some advice:

1.) In my opinion, Short Term Rentals (STR) is not real estate investing in the conventional sense. It’s the hospitality business. There’s nothing passive about it. Just like flipping houses isn’t passive income. It’s another J O B. (I was an Airbnb host, and the last straw for me was when I got a bad review because I forgot to refill a salt shaker 😱, so I converted the unit back to a long term yearly rental). However, the business does have scale. So if you plan on owning one STR, it’s easier to own ten. So if your ambition is to own one and only one, don’t waste your time. However if you want to try one out, and you like it, plan on acquiring more. 2.) There is a high degree of regulation risk. A municipality can put you out of business with the stroke of a pen. As Airbnb’s get more popular, popping up everywhere, it only takes a few instances of some wild bachelor parties or pop up brothels (this has happened to hosts I know) for a town to crack down and before you know it, your listing will disappear off of the STR platforms. So make sure you run your numbers as if it was a long term rental and make sure the numbers work in the event that this happened. 3.) In terms of location, this is even more important than long term rentals. Make sure you are starting in a location that is desirable to travelers. The log cabin out in the middle of nowhere might be appealing for a writers retreat or Instagram photos but it lacks mass appeal to keep bookings high and not succumb to hyper seasonal demand. Choose a location that is either well traveled by leisure or business travelers and has attractions and amenities that are appealing to out of towners. For instance, the first Airbnb I owned was walking distance to museums, restaurants, bars, and parks as well as being close to hospitals and universities. We were consistently booked throughout every month. Hope this helps!

4 Comments

There was a post this week on a real estate forum I follow. It is an investor who owns 4 investment properties free and clear (no mortgage) and wants to scale into larger multifamily deals but has no cash; all of their capital is locked into properties they have rented out. A link to the original post is on BiggerPockets, a social media platform for real estate investors. If you haven't done so already, check it out, create a profile and subscribe to their podcasts. There's a wealth of free information on there. The link to the post is here:

www.biggerpockets.com/forums/12-starting-out/topics/979053-4-properties-and-no-cash-now-what "Bryce, I've been in your shoes. The challenge of the typical real estate investor is that you are always running out of money. Asset rich, but cash poor to grow your real estate business. A couple of options for you here: 1.) You can cash out refinance and hold the cash out proceeds on your books until you find a larger deal you want to purchase. Yes, you are paying interest on utilized cash but it's good to have dry powder when you're ready to pull the trigger on something. If you don't do this... I always say "opportunity never comes at a convenient time." I guarantee you, when you find your perfect larger multifamily or commercial deal, you are going to be scrambling to refinance your three properties, and the opportunity will slip through your fingers. 2.) Find a deal with a seller who will allow you to put their property under contract contingent upon you selling your property or properties and doing a 1031 Exchange. Problem with this, is that not all sellers will be comfortable with this type of contingency or a contingency like this will render you uncompetitive. 3.) Do a cash out refi with a hard money lender, and use the cash out proceeds as a down payment on your larger deal. This would enable you the flexibility of getting your down payment money quickly but cost you in terms of higher interest rates. Most hard money lenders will charge between 8-16% interest effectively; much higher than the banks. Then refinance the hard money mortgage with conventional permanent financing with a bank. Or if the larger deal you are buying has enough meat on the bone from a value add standpoint, you can force the apprecation by stabilizing expenses, pushing rents after performing improvements, and then refinance your new deal and pay off the hard money loans on your condos. This scenario would require you to walk the knife a bit and add a lot of moving parts or variables which you might not be comfortable with. 4.) Raise the downpayment money for your larger deal from people who have cash. In one of our recent blog posts (which is here), we covered that in this low interest environment there is a big problem out there. People with cash don't know what to do with it in order to earn a higher return without taking unnecessary risk. We partner with these types of investors and pay them 8% on their money, which is much higher than their bank or bonds or any other safer fixed income instrument out there. We use this capital to purchase and improve property and then pay them back once we've executed our value add strategy for the property. Once we've significantly improved the property's net operating income (NOI), we take it back to our bank and they give us a higher loan amount which allows us to pay our investors back. (If you, the reader, are interested in learning more about our opportunities, get on our OakGrove Capital distribution list HERE) If I were you, I would go with option 1. With rates as low as they are right now, you are essentially shorting the dollar. If you needed a place for the cash for a year or so, perhaps you could be a hard money lender yourself and make some money on the spread until you are ready to purchase something larger. I hope this helps! Congrats on being a stay at home parent. Being a good and present family person was my top reason for earning my financial freedom. I was able to accomplish that by scaling into larger deals. From a real estate investors perspective (or any investor's perspective) for that matter, things are pretty weird out there! Over the last two years we have not been able to find any opportunities that match our traditional investment criteria. What we have made an investing career out of is buying stabilized value add commercial and multi family property. Stabilized means that the investment property you are buying is not distressed. Think low occupancy sub 80% occupancy or significant deferred maintenance or both. The reason we have focused on this type of asset class is because:

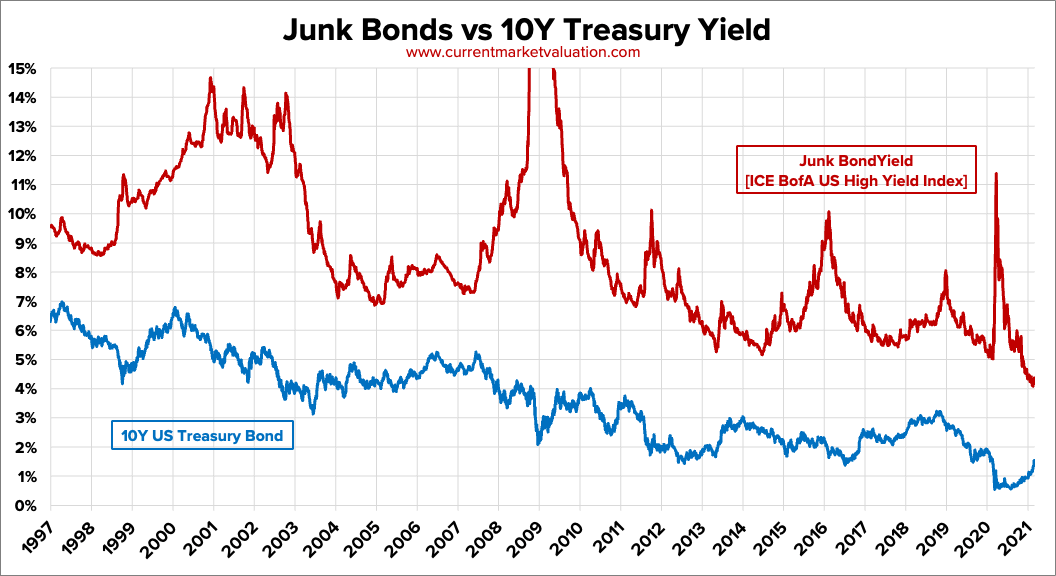

When prices go up, the market starts to get riskier in our eyes. We are value investors who take risk management as our #1 responsibility and the reason we like real estate is because it's low risk... if you buy right. Next, I will explain a very reliable measure of risk that concerns us right now. Above is chart of the historical interest rates of junk bonds versus 10 year treasury bonds. Junk bonds are debt issued by companies that are what is termed "non investment grade." These companies have some type of financial issues that make them riskier than their peers and therefore need to offer a higher yield than companies with investment grade status as rated by agencies like Moody's and Standard & Poor's. 10 Year Government bonds are considered having zero default risk and their historical yields are featured on the blue trend line above. Junk bonds rates usually average around a 9% annualized yield. They are now trading at 4%, less than half the historical average! This is a clear indication that there is a lot of money out there and it is chasing, nay starving for yield. So all that excess cash has been flooding the real estate markets and alternative asset classes of all types. So what have we been doing at OakGrove Development? Well over the past two years we have found a real estate niche that no one is chasing: vacant commercial buildings in the path of growth that we can purchase at a significant discount to replacement cost. When you buy a vacant building, there are significant risks involved. These include lease up risk and construction risk. Lease up risk is the risk that you won't be able to find tenants for your property. This is a very inherent risk in office, retail, and industrial type asset classes. If you cannot find tenants, carrying costs can quickly get out of hand and defeat the purpose of owning investment real estate, which is CASH FLOW. Construction risk is even if you do find a tenant for vacant space in the building, you will probably have to build it out for them. Sometimes these build outs can be quite expensive and lengthy, and if you have cost overruns your project might become upside down very quickly (putting more capital into a building than what it is worth.) Plus, vacant buildings are hard to finance. Banks won't touch them if you do not have tenants in hand. Therefore it eliminates a lot of competition from most investors who depend upon bank financing to buy most of their deals. So how do we mitigate these risks?

2.) We have been buying properties in areas that are in the path of growth or progress. In other words we have buying properties that are located adjacent to very large catalytic projects which will bring a huge influx of capital and therefore people. For example, 17 East Main Street is located right next to the $28 million dollar redevelopment project known as The Aqueduct District, a mixed use redevelopment project being undertaken by Landers Communities and billionaire Rob Sands of Constellation Brands. The project will feature over 120 new apartment homes as well as restaurants, a yoga studio, and Co-living micro studios done in partnership with Common, a national co-living brand. Among many other smaller private redevelopment projects in the pipeline there is also the $500 million ROC The Riverway project whose locus is right around where the subject property is. When we invest in projects in the path of growth, our buildings can benefit from the halo effect of these larger projects and we can ride on their coattails, so to speak. We prefer to be market takers not market makers. As real estate author David Lindahl said: Don't be a pioneer. Pioneers are the ones that wind up face down in the mud with arrows in their back! I hope you find this helpful and interesting! If you would like to talk shop on real estate investment contact us anytime! If you would like to join our private lenders network, please join our distribution list below! We pay 8% interest to our lenders on two to five year terms, with payments made monthly via ACH. Our lenders are secured by real estate and backed personally by myself and partner David Martin.

You might have been noticing rising prices lately... on well, just about everything! Food, energy, commodities like building materials, wages, etc. Your dollar seems to be purchasing less and less. This inflationary effect essentially means that the dollar and other world currencies are falling in value. The rich find effective ways at "hedging" against inflation in order to preserve and grow their wealth. Below are some popular assets for hedging against inflation:

2.) Crypto Currency. With the rise in skepticism about the value of the dollar and other world currencies, crypto currency or currency that is created privately outside of the purview of central banks has become used widely as a hedge against inflation. Governments don't control the cryptocurrency markets so they cannot devalue it through deficit spending. In the short term, cryptocurrency like Bitcoin has far outpaced inflation. In October 2013, a Bitcoin was valued at $120 per coin. Fast forward to April 2021, and that same coin traded for $63,000, and then traded for $32,000 as late as June 2021, a fall in value of almost 50%. Here are my thoughts on cryptocurrency: a.) Inflation hedging should first be an act of capital preservation, not gambling in order to beat inflation. Even though prices on commodities have skyrocketed in recent months as things get slightly back to normal, there really isn't a correlation between the consumer basket of goods and the price of cryptocurrency. A lot of the velocity of money that has flowed into cryptocurrency has largely been speculative and not from a demonstrable devaluation of the world's fiat currencies (currencies controlled by central banks). b.) Cryptocurrency is still not used widely as an actual currency. Even the largest advocates for the currency aren't using crypto in their routine exchange of goods and services. Meaning that even those who buy the currency don't use it as.... well.. currency. Currency was invented to be a temporary store of value in which to exchange goods and services, not to stock pile and speculate on its rise in value. Currency, having the root word "current" is designed to be constantly moving. c.) As an investor, I am not a fan of any currency, much less cryptocurrency. My mantra is "cash is trash", that's why we as real estate developers try to get rid of cash as quickly as possible and convert it to hard assets like real estate which create rising cash flows over time. 3.) Fixed Income. I will classify fixed income as anything that returns predictable incremental cash flows over time that are not FDIC insured accounts like checking, savings accounts, CDs and money market accounts. These can be government bonds, corporate bonds, mortgage backed securities, preferred stock, or private mortgages. Typically fixed income investments are a decent low risk tool in hedging against inflation. But in the wake of the pandemic, the Federal Reserve Bank cut short term interest rates as well began buying tons of treasury bonds to help keep interest rates very low. This has resulted in very low yields for intermediate term bond funds and government bonds. Sub 2% yields in many of these classes of investments have become the norm, which barely keeps up with inflation. Although these asset classes can be an effective capital preservation tool, they are not all too effective in growing your net worth. Furthermore, there is a significant amount of interest rate risk that goes with these types of investments. What is interest rate risk? Let's paint a scenario. Say you purchase a $100,000 5 year bond with an annual coupon of $2000 per year, or a 2% interest rate. If interest rates for similar bonds go up to 5%, what do you think that does to the value of your investment holding? Would you buy a 2% interest rate bond if you could buy the same type of bond that yields you 5%? The market takes account for this increase in interest rates by devaluing your 2% bond significantly. So if you needed to redeem your bond in a rising interest rate environment, you would actually lose a significant amount of your investment. Even if you held onto this bond until it's maturity, you wouldn't lose any your principal balance but you would have incurred an opportunity cost. You COULD have been earning 5% instead of 2%. This interest rate risk becomes even more pronounced if you buy longer term bonds or other fixed income instruments in this environment. An alternative fixed income instrument is investing in debt like private mortgages which are backed by a hard asset: real estate. As a real estate developer, we partner with private lenders who wish to get higher returns backed by real estate and managed by an experienced operator that they know. These investors can earn any where from 7% to 12% per year. The operator then use these funds to purchase and develop cash flowing real estate assets. The term on these loans can be anywhere from 1 year to 10 years depending upon the objectives of the private lender. It's very customizable and the lender is in control of negotiating the terms and what type of collateral they are comfortable with! Incidentally, if you are interested in real estate lending, we are always looking to build relationships with private lenders to help us grow our portfolio! 4.) Stocks. Stocks, also known as equities, offer a great long term inflation hedge and opportunity to build wealth. The S&P 500 index, a basket of the 500 largest publicly traded US companies have averaged a roughly 8% annual return since it's inception in 1957. Investing in stocks is very easy. You could literally convert your cash into shares in an S&P 500 index ETF and back into cash before your morning breakfast. Which leads to one of it's greatest advantages, liquidity. This makes it easy to buy and easy to sell. Because it's easy to buy stocks, you can invest any bit of money, at any point in time without having to research or having a transaction lag time. Easy to sell in the event that you really need the cash for an unforeseen opportunity or if you find yourself in a rainy day scenario. The reason why stocks are an effective inflation hedge is when you think about it, companies that are listed on the SP500 sell a lot of consumer goods, i.e. electronics, energy, food, building materials, etcetera etcetera. When inflation is on the rise, they might have a little trouble absorbing the increase in the cost of goods sold in real time, however they usually are successful in passing the costs onto the end customer, which ends up positively affecting their bottom line and positively affecting their stock price. Now, don't get me wrong, there are always some losers and some winners in terms of companies in an inflationary environment but the S&P offers diversification, which helps manage risk through diversification. The major downside to stocks is volatility. If you keep tabs on the market, the market can be up 5% one day and down 5% another day. The reasons why this is problematic for investors are:

5.) Real Estate. There is a multitude of reasons why real estate is an effective inflation hedge. Now for the sake of this argument, I mean ownership of actual real estate either via a partnership or sole proprietorship. I do not mean owning real estate via shares in a publicly traded REIT (Real Estate Investment Trust.) I would classify that as a stock, not real estate for these purposes (by the way, there ARE REITs in the S&P 500 index).

One of the most glaringly obvious reasons why owning income properties is a good inflation hedge is "rent always goes up." Over a 30 year period, do you think rents will go up or go down? Even in the most rural destitute town or crumbling rust belt city, rents go up eventually, although slower than in higher population areas. But you may say, well of course rents go up but the landlord's expenses go up too. So don't those two things cancel each other out? The short answer is no. For example, let's say you own an apartment building with $100k a year in rents. Most multifamily operating expenses usually run at 50% of rental income. This is called an expense ratio. To be conservative, lets say you project rents to inflate 2% per year and expenses to inflate 3%. So your rents go up to $102,000 and your expenses go up to $51,500. You net operating income still went up $500 even in that scenario. The second plug for real estate is low cost, high loan to value leveragability. Even if you don't believe that rent will be higher in 30 years, do you think the value of the dollar will be higher or lower in 30 years? If you think it will be lower in 30 years, then keep reading. The reason why it's smart to use bank money to purchase real estate is, one, it allows you to purchase more property with the cash that you do have, and two, when you borrow money to purchase investment real estate, you are essentially "shorting the dollar." Let me explain. When you purchase an investment property using the banks money, you are essentially borrowing cash from the bank in today's dollars and immediately selling that cash to the owner of the property you are buying. Then over time, you "buy" the money back in depreciated dollars (paid by your tenants!) and return it incrementally to the bank. If you have a 30 year fixed rate mortgage, your payments do not go up over the life of the loan, while at the same time, your rents go up over that same period; increasing your cash flow. Let's say you buy a single family investment property for $100,000. You put 20% or $20,000 down. Let's assume this property will rent for $1,000 a month (a classic 1% rule property). You get a 30 year fixed rate mortgage at 3.92% interest on $80,000; $378 monthly payment. Let's assume expenses are 50% of the monthly rent or $500 per month. Let's also assume expenses will rise 3% per year and rent will too. In year 30, the rent would be $2356 per month and the operating expenses would be $1178. The mortgage payment would still be $378, leading to a monthly cash flow of almost $800! It went from $122 a month in year one to $765 a month in year 29! Sounds amazing, right? Well real estate has a couple of major flaws:

The busy season in leasing, move ins and move outs is nearly at our door step. Like most management companies and real estate investors, we have a majority of our lease expirations stacked in the spring to summer months. The reason for this is quite simple, in our region this is the season people think about moving. The reasons your resident might want to move can be one of many. Either they are wanting to purchase a home, consolidate households (people moving from a 1 bedroom to sharing a 2 bedroom apartment with someone else), deconsolidate households (think of three roommates wanting to get their own studio or one bedroom), poor living conditions or poor maintenance performance from their housing provider. Most reasons your residents choose to move out are controllable. That's why it's best to have a comprehensive retention strategy in place to keep your residents longer. By the way, a move out costs a property owner on average $2500 per unit, between vacancy loss, make ready costs, and leasing fees! For information on our retention strategy, visit our blog post here. But some move outs are just unavoidable. The typical property owner will post their apartment home as available 30-60 days prior to the current residents move out date. And then perform their make ready of the unit after the current resident moves out. This type of make ready work can consist of cleaning, painting, and other minor repairs which can cost most property owners from as little as two weeks to one month of vacancy loss. If you multiply this over several units, the costs from vacancy loss alone can be staggering. For instance, if you apply this scenario to our portfolio of 102 units, assume we have a 50% turn over per year or 51 units, with an average market rent of $800 per month. If we incur 2 weeks to 1 month of vacancy loss, this can translate to a yearly vacancy and collection loss of $20k to $40k per year! That's essentially someone's salary! Having a vacancy management strategy in place is mission critical to the sustainability of your business! Here are some tactical stuff that we use to manage minimal vacancy loss as a management company:

In addition to helping reduce vacancy loss, these tactics will be helpful to having a more pleasant move in experience for your incoming tenant. Remember, if your new residents have a bad move in experience, they will hold it against you, and you can take the likelihood of them renewing their lease next year and kiss it good bye! We hope that these tips help you in making your rental business more profitable and your residents much happier!  Taxes are one of the largest single expenses that Americans face on a yearly basis. The IRS wrote a rule book intended for you to take advantage of their rules in order to reduce your taxes. A couple of weeks ago, I posted a video (on social media) about how one of our investment partners earned tax free (more accurately tax deferred) cash flow on a deal they partnered with us on. Not only that, but they grew their net worth without growing their tax liability. Not only that, but their investment also earned paper losses which sheltered income from their job, helping them save $5,000 on their Federal income tax bill alone! How is this possible? Watch my really cool fast paced video explanation above! Or you can read it here: We typically purchase properties with an 8.5% percent rate of return before annual debt service (ADS); this is also known as an 8.5% cap rate (capitalization rate). So on a million dollar multifamily property, it would throw off $85,000 in net operating income (NOI); we would have a 27.5 year depreciation schedule on that property or $36,000 in annual depreciation expense. Now depreciation is a "paper" expense, not an actual one. The IRS allows you to use it to offset current income. Since we typically don't have $1,000,000 laying around, we rely on our banking relationships to help us buy the property. Banks will lend you up to 70% to 80% of a property's appraised value. So lets assume we secure a loan that is 80% loan to value (LTV) on a 20 year amortization at 4.5% interest. The annual debt service on this loan would be $60,734, giving us a before tax cash flow (BTCF) of $24,266 or a cash on cash rate of return of 12% (Before Tax Cash Flow Divided by Down Payment.) Unfortunately the IRS does not allow for deduction of principal pay down. For simplicity sake let's just assume that the interest portion of the ADS is $35k. So if we take our $85,000 NOI and subtract the $35,000 interest payment, we would have a taxable profit of $50,000. If we didn't have depreciation as a tool provided to us by the IRS, our annual tax on that profit would be $15,000, assuming you have a blended tax rate of 30%. But because WE DO have depreciation as a tool, we would subtract the $36,000 depreciation expense from that profit, effectively reducing the taxable income to $14,000, which reduces our tax to $4,200 on that investment income; a $10,000 annual tax saving! Why is reducing your taxes important? Yes, sure it's cool to have more money in your pocket to buy stupid things you don't need, but the real power is in the time value of money. If you save on taxes now and reinvest those savings over time, it has an INCREDIBLE power to grow your wealth exponentially! Now the $10k tax savings illustrated in this video doesn't seem to be a lot of money, but consider it's reinvestment potential over time. If you save $10k a year in taxes, reinvest that sum with a 15% annual rate of return (which is generally what we earn on our deals), over a 30 year period, you would wind up with over $7 million dollars! Plus the more property that you buy, improve and leverage over time the more depreciation and paper losses you generate which can help you shelter income tax liability on your earned (W-2 or 1099) income. Since we buy and develop value add commercial investment property, we generate paper losses which also helps all of us shelter earned income from our jobs too. See we typically purchase underperforming, under improved property which we fix up and do capital improvements on. Thanks to bonus depreciation, we can accelerate the depreciation on these capital improvements faster than the 27.5 - 29 year the IRS allows us normally. You need a tax strategy. That's what your accountant is for, talk to them!  This subject might be a little off topic from the usual real estate subject matter, however, I thought it important to share my own personal development in the wake of loss. February 26th, would have been my Dad's 69th birthday. For those of you who don't know, my Dad Mike Drouin died unexpectedly from a heart attack in August of 2012. He was a hero and leader to our family and community. Unfortunately, Dad isn't the only death that has happened to a close family member. My Mom, Debra Drouin passed away from an extended battle with cancer in 2003. My grandfather, Roger Drouin (pictured here on the right) got hit and killed by a narcoleptic man driving a work van while walking in his own neighborhood. Death has taught me some very invaluable life lessons: 1.) Live with no regrets. Your dreams cannot wait for a convenient time. You need to start working towards them TODAY AND EVERYDAY. You need to live with a sense of urgency. When my mother knew she didn't have long to live, she decided to live out her lifelong desire to travel Europe. And she did so with my grandmother Ruth. She was incredibly weak and had to use a cane to get around. It was a struggle for her. For those of you who have traveled to Europe, it's not exactly a friendly place for people with mobility issues. If it wasn't for her sense of urgency, she might have never gone. You shouldn't have to wait until your twilight to do what you actually DESIRE to do. 2.) Never go to bed angry at someone. You are bound to get into arguments and squabbles with people you love. If you walk away from someone, imagine if they died or you died. Did you have the opportunity to reconcile with them, or apologize, or tell them you loved them? At my fathers funeral, someone close to him was there who was terribly sad, sobbing uncontrollably. I knew why. The last time they saw each other was on very bad terms. They had an argument about something incredibly stupid and left each other in bitter anger. So remember, when you say goodbye to anyone, make sure you do it graciously. Tell them you love them because you might never get a chance to do so again. I hope this insight finds you well when dealing with loss of a loved one!

As real estate professionals, we have been getting asked this question A LOT lately, by home owners and real estate investors alike. You've probably heard that historically low interest rates and low inventory have been driving the real estate market higher, not just in Rochester NY, but across the entire country! So this begs the question, "when will we hit the top of the market?"

Well.. in short... not any time soon. Here's why:

"NO INVENTORY!"

The law of supply and demand apply to all markets and their subsequent pricing. Demand has remained strong in Monroe county, not due to an incredible influx of population or a booming local economy but due to creation of new house holds. It's essentially "butts moving seats." Millennials move out of roommate situations and purchase their own homes to get their own space. When that demographic group purchases a home, the family that is selling their home to the first time buyer usually buys another home, which creates demand up the entire real estate food chain. Typically what alleviates this market inefficiency in most markets is supply will be stimulated through rising prices. This is true to most markets, but real estate has an incredibly long lead-lag time. The risk associated with developing new housing, the meteoric rise in the cost in materials, restrictive local zoning laws (which also artificially stem new housing development) have rendered the construction of new housing extremely cost prohibitive. And even with the rise in pricing of existing single family housing we've seen recently, home prices are still trading at a considerable discount to replacement cost.

Incidentally, supply of existing single family homes is actually down quite considerably from last year. In January 2020, there were 950 homes put up for sale in Monroe County. In January 2021, 622 homes! Supply down almost 35% according to data from InfoSparks, a real estate data platform that aggregates housing market data.

Housing Is Still Very Affordable

Because of the lack of supply, you can see how market pricing has been affected in the chart below. The median price has increased from $155k to $173k, an 11.6% increase in just one year. The main reason we believe that prices will continue to increase is, even at these elevated prices, housing is still remarkably affordable in our market when you compare it to national housing affordability metrics.

The Factor Of Area Median Income

According to Census.gov, the 2019 Monroe County Area Median Income (AMI) is $60,075 per household. Even with median home values at $173k, housing is still a bargain! On average American households spend between 30%-40% of their income on their housing costs. Keeping no more than 30% of income allocated to housing costs will ensure a home buyer doesn't become "house poor" or housing cost burdened. 30% of AMI is about $1500 a month in Principal Interest and Real Estate Taxes before a household would start to become financially burdened. If the average Monroe County resident bought a $173k house, put 5% down and locked in at today's 30 year interest rate of 2.962%, their monthly mortgage payment would be $688 month. At an average tax rate of $36.25 per $1000, the real estate taxes would be $522 a month (this could vary by town, but we used the average for demonstration purposes). Total monthly payment? $1201 a month or 24% of AMI. In order for monthly housing costs to be in line with 30% of AMI, or $1501 per month, housing in Monroe county would need to appreciate 24% to be in line with what average financially conservative Americans spend on housing!

Rising Interest Environment Not Likely

Obviously, rising interest rates could have a hand in tempering a rise in housing prices, but with the Federal Reserve Bank's (The Fed) continuing quantitative easing (QE), a rising interest rate environment does not seem to be likely any time soon. Keeping unemployment low is one mandate of the Fed but it's not the only mandate. So, what about inflation leading to rising interest rates? Significant inflation does not seem to be on the horizon either. With the world reeling from the affects of COVID-19, global financial markets have kept their flight to safety in buying bonds denominated in the worlds reserve currency, the US dollar. Furthermore, our friends in China help keep interest rates and inflation low by maintaining themselves as a huge buyer of our debt too.

The Bottom Line

If you are considering buying a home or investment property, don't wait on the sidelines trying to time the market, because you may end up paying more for it later.

A special word of caution for real estate investors. Do not buy on speculation of future appreciation. Only buy based upon good current fundamentals: a good location and cash flow based upon REAL NUMBERS, projection of actual rents based upon market rents of comparable product and factoring in adequate expenses for vacancy, collection loss, property management fees, realistic repairs and maintenance, and capital expenditures. I have been seeing a lot of irrational exuberance among real estate investors not using realistic financial projections. So be patient, but strike quickly when opportunity knocks! *** Disclaimer: I am not an accountant, lawyer, or financial advisor! You should consult with a qualified professional before acting on any of the opinions shared in this post!!! ***

Self directed IRAs have become very hot among investors with the rise in popularity in alternative investments such as real estate, gold, and cryptocurrency. They allow retirement account owners to invest money in assets that your traditional IRA or 401k would not. Typically they have been restricted to Wall Street type products like stocks, bonds, and mutual funds. Typically around this time of year, investors are looking at maximize their retirement account contributions before the April 15th tax filing deadline. Something really stupid I have seen people doing is buying real estate using their Self Directed IRA. It's stupid for a multitude of reasons, here's why: 1.) Real estate is illiquid. Retirement accounts are illiquid (at least until you reach an age to start taking distributions.) Why would you want to double down on the biggest risk involved with real estate, liquidity risk? Besides, I am not even a fan of tax advantaged accounts like IRAs and 401ks because you cannot do what you want with your OWN money. I value being nimble and having options. This scenario is very restrictive. 2.) Lack of leveragability. One of the best parts of the real estate asset class is that it is a hard asset. Banks love hard assets as collateral and therefore allow you to leverage them. Which means you can buy and control a $100k for $20k essentially or whatever your bank will allow you to do. This allows you to scale multiples on your net worth over time. For example. Let's say you buy a property for $100,000, all cash, no leverage. Let's say that property appreciates 3%, pretty average for Rochester, NY in good locations. Let's say you sell that property for $103,000. That $3000 return on investment yielded you 3% return on your money. Now, lets say you buy that same building and put bank financing on it. So you put $20,000 down and have your bank put a $80,000 mortgage on it. The property appreciates 3% or by $3,000. $3,000/$20,000 = 15% return on investment. Plus you can buy 5 properties using that same type of leverage; much better for building your long term wealth! With Self Directed IRAs (SIDRA), you cannot use bank financing in this way. Why not? Because most bank financing requires personal guarantees, something strictly prohibited by the IRS in Internal Revenue Code Section 4975, therefore precluding you from using leverage. There might be come convoluted ways in which to get around this but at the end of the day usually doesn't make sense. 3.) Lack of tax benefits. Yes, SIDRAs and other tax advantaged retirement vehicles have tax advantages in their own right but it ends up stripping out one of the greatest part of owning investment real estate, depreciation! Depreciation is an expense that you take "on paper" each year you own a piece of investment property. When you own desirable real estate assets in great locations, you pay for it. You usually have a higher cost basis when you buy great property. You can take a certain portion of that basis as an expense each year. Often times that expense synthetically wipes out positive cash flow while you own the property. Assuming a dollar today is worth more than a dollar tomorrow (it's a fact, look up "Time Value Of Money"), the less you pay in tax today, reinvest those tax savings, it's quite simply explosive to building your net worth over time. So now that I've thoroughly trashed buying real estate with your SIDRA, you should know some tactics on how to use your SIDRA to grow your real estate business. One tactic that is my favorite is making loans out of my SIDRA. Loans that are backed by real estate. You can make loans out of your SIDRA with interest rates and terms more attractive than typical private or hard money. Why would you do this? Relationship building. If you have a reciprocal relationship with another investor with a SIDRA, you can loan them money to help them grow their real estate business and they can lend you money to help you grow yours, without the crushingly brutal rates of some hard money lenders. Another way to invest is by investing in an LLC or special purpose vehicle as a limited partner (silent partner) and partnering with the managing person of that LLC in exchange for an equity stake. Again, it would still be best to do this not using your retirement accounts for reasons stated above, but if it's the only way for you, it's the only way! The only caveat is to make sure that whatever bank financing that investor is using will allow your IRA to own membership interest in that deal without having to sign a personal guarantee. Usually you can avoid personal guarantees by having your IRAs membership interest at 19% or less in that LLC. What are your thoughts on this? Do you invest in real estate with your SIDRA? BRRRR! BRRRR? Yes it's cold outside, but BRRRR is a widely used strategy used in the world of investment real estate. It stands for Buy, Rehab, Rent, Refinance, Repeat! It is a strategy that allows developers to grow their portfolios exponentially over time and recycle the same investment capital over and over again. This is how you can build a real estate empire essentially without access to cash being a bottleneck to your growth.

OK, now story time: About 3 years ago, I got contacted by a real estate broker about a commercial property he was going to be listing in an area where we own property. When I asked him the price, my jaw dropped. The price was $1 million dollars! All those zeroes and commas! I have to tell you I ,was intimidated. We knew the property was worth a million but I offered $947,000 because, well, we were more used to 6 figures. The seller immediately countered at $1,000,000. So I contacted my lender and asked if they could do 80% LTV and a 25 year amortization to make the numbers work better. (We had a required on cash on cash rate of return of 11%, and the only way to conservatively get there was by having the lender do a policy exception. They usually only do 75% LTV, 20 year amort or 80% ltv, 25 year amort.) Due to our relationship, they said "yes" and made a policy exception. So I was going to need $200k for down payment, and $100k for closing costs, operating capital and some capital for some property improvements. $300k, which I didn't have... After getting the property under contract, I quickly got to performing due diligence and putting together my pitch deck to start raising the capital, another thing I never did before. I was used to presenting opportunities to lenders so I took the same approach to presenting to potential equity investors. Believe me, I was sweating. Especially after I put $50k in earnest money down. Yada yada yada, so last week, we just closed the cash out refinance and I took home a darling check for $310,000, which was pretty cool to see in my bank account for 2 seconds before I wrote a check for $300k to pay my investors back! Now that I have your attention, if you want to review the very long winded manner in which we pulled this off, continue to read below. If you are happy with the yada yada yada version, you can stop here, mask up and give me a virtual (covid friendly) high five! Raising the $300k was a lot easier than I anticipated. Why? 1.) The asset was in a great location. 2.) The projected numbers were very conservative; income conservatively low, expenses conservatively high; so the investors knew that I wasn't B.S.ing them with pie in the sky financial projections. 3.) The asset was 100% occupied and had history of strong occupancy. The business plan was simple: raise rents to market value as leases expired (they were drastically under market based upon our market survey and the fact that it seemed to always be at 100% historical occupancy), and normalize expenses. The expenses were abnormally high. Utilities were God awful high and the management company had a maintenance employee stationed there for half the day, every day. AND they were paying for their snow removal company to salt and shovel the sidewalks to the tune of $10k a year. These were just a few items of financial waste discovered. During our due diligence: 1.) We found that 20 hours a week was not necessary for a maintenance employee on a 20,000 square foot building. The management company swore that he was needed there... and the tenants loved him... and he would be sorely missed if he wasn't there everyday. Through right sizing and only having maintenance there on an as needed basis and for proactive trips, we were able to save $20k per year! 2.) In analyzing the utility bills with my energy consultant (shoutout to Enlightened Energy!), we found that the electric usage was just as high during the winter as it was during the summer. This didn't make sense. It was normal to be high during the summer with the usage of air conditioning with the expectation that the usage would taper off in the winter. The building was heated by steam during the winter. When we dug into it further, we found that the air handlers for the A/C units were not shut down at the end of each cooling season. Tenants had thermostats in their office suites that they had set at 68 degrees. The building wide thermostat for the steam heat was set at 70 degrees! So imagine that, the A/C and the building steam were fighting with each other the whole winter! Furthermore, we found out that the management company maintenance person had the pressure for the boiler dialed up so high that the whole steam system was packed with a head of steam (at all times!), so that the individual tenants had on demand steam. By the way, this is not way steam heat systems work. This was not only wasteful from an energy perspective, but it was also putting undue stress on the newer $50k boiler that was installed by the previous owner! Through a small investment in an energy consultant and having them integrate real time energy management, we were able to save about 30%, or $10k per year. 3.) I put the snow removal out to bid and we found a company to do it all inclusive, unlimited trips, and snow shoveling for $5k per year. $5k in savings. 4.) By increasing rents up to market as leases expired, we were able to push the annual revenue to $225k from $198k. After executing this plan we were able to squeeze an additional $60k per year in NOI (Net Operating Income)! In order to capitalize on the low interest rates and positive lending environment, we jumped on getting the asset refinanced. The property reappraised at $1.4 million so we were able to refinance and pay our investors back. Now we have an appreciating asset that cashflows over $40k per year! Now we're looking for our next $1,000,000 BRRRR deal in Rochester, NY so if you know anyone who owns commercial property in a great location please think of us! Or if you'd like to invest with us, get on our distribution list here to learn about our next opportunity! |

AuthorThis blog serves an an outlet for all of our invaluable team members to share their insight on development, property management, and all things affecting real estate in our community. Archives

July 2023

Categories |

RSS Feed

RSS Feed