|

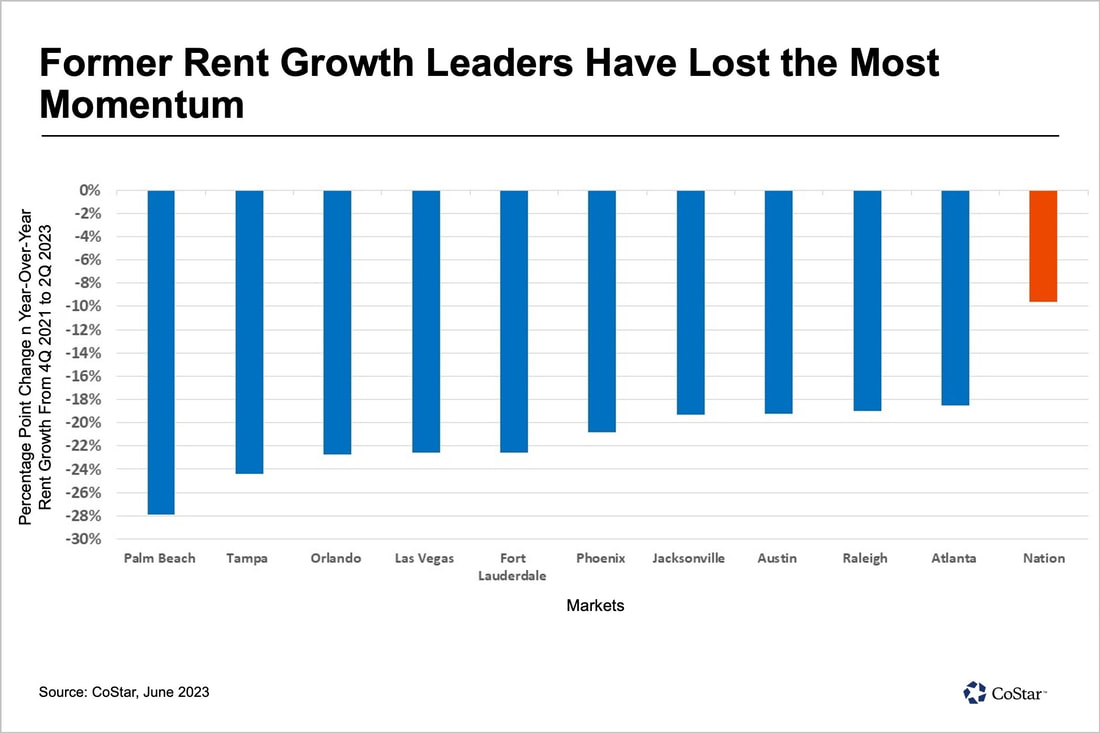

Don't let the headlines fool you on the fundamentals of your own market. The most recent multifamily reports that you'll see is a significant pull back in rent growth, even some recently high flying markets have had negative rent growth, like Tampa, Phoenix, Austin, and Atlanta, some as high as a negative rent growth of 24% from 4th Quarter 2021 to 2nd Quarter 2023!

The pull back in these markets is due to a confluence of many factors, but it started with these environmental factors:

For these markets, the last 5 years have been a seemingly never ending party! But now, they are dealing with a hangover. But not Rochester, NY! We've maintained our status as the "steady eddy" of real estate. In a nut shell, rent growth has remained elevated but not sky high. So the low interest rate environment dovetailed with "good but not great" demand has kept new inventory low and absorption of any new product very healthy.

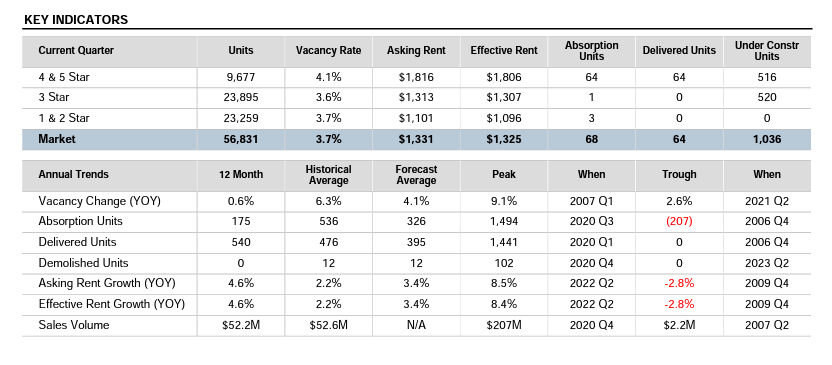

Turns out Rochester is not the only market in the US that has not fallen victim to the headline numbers. "Midwest and Northeast markets remain the most stable given their more modest construction pipelines and are projected to see rent growth in the 2% to 3% range into 2024." As a region, our relatively anemic rent growth and job growth has prevented developers from appreciably adding to new supply of multifamily housing. According to Costar (a real estate analytics firm): "Vacancy in the Rochester multi-family market is 3.7% and has increased by 0.6% over the past 12 months. During this period, 540 units have delivered, and 180 units have been absorbed.... Rents are around $1,330/month, which is a 4.6% increase from where they were a year ago.... About 1,000 units are under construction, representing a 1.8% expansion of inventory. There have been 22 sales over the past year. Sales have averaged $85,330/unit.... Over the past three years, there have been 122 sales, which have traded for approximately $277 million. The market cap rate for Rochester is 7.1%, slightly above its trailing three-year average of 6.9%...." However, sales transaction volume is down considerably. This is primarily due to high interest rates and a very wide bid-ask spread between what sellers want for their property (the ask) and what buyers can conceivably pay (the bid) while being able to meet their return requirements for their lenders and investors. We've seen it first hand. Not only do we have to pay a lower price for a property, just to meet the Debt Service Coverage Ratio our banks require, but also we need to be more competitive in the annual returns that we offer our investment partners. Just a few years ago, it was easy to raise capital for deals while offering a 7% fixed annual rate of return to our investors when 10 year treasuries were paying 0.55% to investors. Now 10 year treasuries are paying closer to 4% and FDIC insured money market accounts are paying 5%. All of these factors have to be considered when calculating the net present value on any asset we purchase. However, property owners haven't come back down to reality, because they don't HAVE to sell. So it's resulting in sales volume of multifamily assets plummeting to almost 50% of the 5 year average. According to Costar: "Rochester recorded just 22 market-rate trades over the past 12 months, which was near the bottom of its peer group. That translated to the lowest number of sales over a 12-month period in five years, as investors appeared to dial back purchasing activity. Annual sales volume has averaged $101 million over the past five years, and the 12-month high in investment volume hit $207 million over that stretch. In the past 12 months specifically, $51.9 million worth of multifamily assets sold."

We own a fair amount of multifamily in the Rochester market. So are these statistics mirroring what we are seeing across our assets?

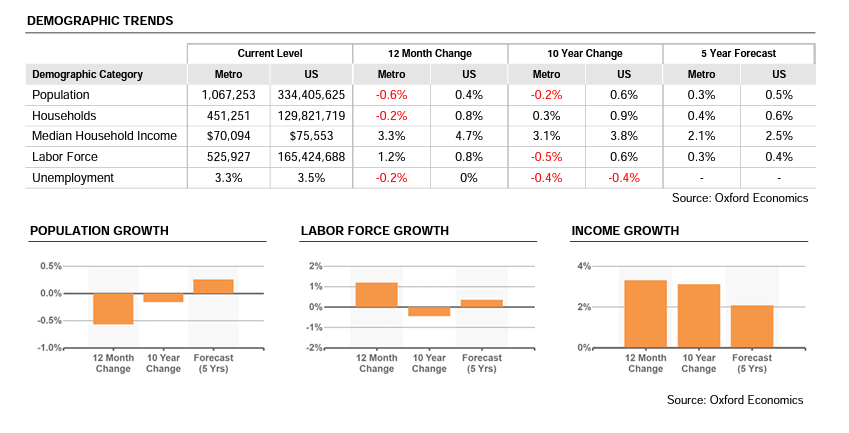

The short answer is "yes" As a company, we've been able to maintain strong occupancy at 97% while achieving organic rent increases of 5.2% across our residential portfolio over the the past 12 months and been able to achieve rent increases on average of 5% while maintaining occupancy of 97% for the year prior to that as well in 2021. In regard to the new acquisitions, our experience has been consistent with the stats as well. Many more opportunities are coming our way through commercial real estate brokers and our work on off market deals direct to seller, but the pricing expectations are not in line with the reality of interest rates and our investment return requirements given the current state of what our investment partners are now demanding given how high returns have been driven in "risk free" assets like MMA (Money Market Accounts) and other fixed income products. This has been primarily the result of the Federal Reserve's monetary policy to help curb inflation. So that's a snap shot of local multifamily. What about the local economic fundamentals in Rochester? As you will see, the underlying fundamentals in our region remain steady. Although there are no foreseeable catalysts in turbocharging household incomes or population growth, there are no foreseeable cataclysmic events that should shake that up. Rochester has gone through it's changes. We no longer have the corporate behemoths of Kodak, Bausch And Lomb, or Xerox. But out of their ashes, we've risen, possessing a diversified economy of a constellation of companies largely made up of recession resistant sectors like education and healthcare. Some key stats:

If you are a multifamily investor, be patient. It's going to take some time for bid ask spreads to narrow and create buying opportunities for operators. As inventory starts to tick up, and deals start to stay on the market for longer, some sellers will come to grips with reality. That being said, now is the time to keep prospecting for opportunities and maintain top of mind in your sector as an active buyer. If you own small multifamily 2-4 unit, the market is still red hot. We are jumping on the opportunity and strategically selling off some of our smaller assets that have considerably appreciated in value. We are not a fan of doing 1031 Exchanges right now because of the constrained market on the buy side. Instead we are selling some assets and then performing a cost segregation analysis on some of our larger deals to help defray or eliminate capital gains taxes, and just sticking the cash on our balance sheet to better position ourselves for a potential market shift. Did you find this article interesting or helpful? Would you like to be made aware of future blog posts and industry events? If yes, please subscribe to our newsletter!

0 Comments

For all of the years that I have been trying to read a crystal ball and make predictions about economics, I have to admit that I have been wrong every single time. When predicting, you have to understand that you too, will always be wrong. The objective is not to be right (because that is impossible), but to be less wrong. The Federal Reserve bank has made one thing remarkably clear. They are going to get this inflation thing under control and back to it's target of 2% at ALL COSTS. Jerome Powell, Chair Of The Fed has basically said that the reserve bank is going to ignore its dual mandate of balancing inflation and unemployment and focus solely on its inflation target. Our opinion is that the Fed will overshoot its quantitative tightening policy and the recession will be led by a drop in consumer confidence and thus consumer spending. Below, I feature some stats on why we believe that will happen:

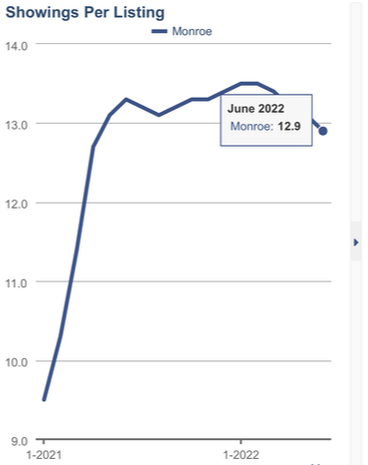

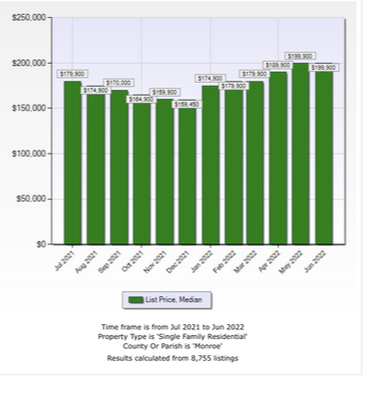

Although we typically talk a lot about commercial real estate on this blog, I would be remiss if we didn't occasionally talk about the single family home market in our region. The reason why it is important is because, single family home sales can help us check the pulse on economics and consumer sentiment that drives other facets of the real estate market in our area. For instance, when home prices go up, home owners feel wealthier. Their home equity goes up and they tap that home equity to fund home improvement projects, or to send their kid to college, or go on a big vacation, etc. Increasing home values also give lift to the economics of new home construction, which has a whole myriad of different economic affects for a given area. On the other side of the coin, rising home prices can also place homeownership or upgrading to a larger house out of reach for many people as well. Below is a recent report of home price performance that has been sorted by each school district in Monroe county. The findings were interesting to say the least and also provided some confirmation of things that I have seen first hand as a REALTOR and heard second hand, anecdotally from my real estate colleagues.

What all of this means is that it costs home buyers over $400 more per month to buy the same house as last year. In addition to that, EVERYTHING is more expensive! Food, energy, cars, healthcare, child care, etc. This definitely has an effect on buyer's purchasing power and also general confidence. With that being said, the supply demand balance still remains strongly in favor of home sellers. The market is not being flooded with inventory. In fact, the opposite is true, the amount of single family homes in Monroe for sale in June 2022 was 439, down 12% from the previous year. This loss in supply has counteracted loss of demand from buyers that may have resulted from the aforementioned information. The reason why price reductions are up significantly is not because, demand is falling. It is because many seller's have succumbed to pricing strategy that is misaligned with this rapidly changed interest rate environment. As Americans, we are not a "what's the price?" culture, we are a "what's my monthly payment?" culture. So if the same house costs you $400 a month more to own over one year, you bet it's going to affect the market. The biggest mistake I see sellers making is looking at recently closed sales comparables as a basis to come up with their asking price. They are making the mistake of using old data. Think about it. If a sales comparable closed three months ago, that means the person who bought that house actually purchased it 6 months ago, because it generally takes 60-90 days to close a real estate transaction in Monroe county. That means that particular buyer bought that sales comp when interest rates were 3%, not 6%! The biggest mistake you can make as a home seller is to over price your house. When you over price, buyers won't make offers and you will soon be reducing the price. When selling your home, time is not on your side. Usually, the longer your house sits, the more likely it will actually end up selling less than if you priced it right to begin with! So, how should you price if sales comparables are based upon irrelevant data? The simple answer is ask your real estate professional!!! But if you are looking for quick and dirty advice, it's better to under price than over price. I tell our clients, price is nothing more than a marketing tool. You want to price your home so that it get's prospective buyers "in the door." If the sales comps are suggesting a median price of $240k, price the property at $199k. If the sales comps are suggesting a median price of $375k, price the property at $349k. If it's a difficult property to compare with recent sales, price it even lower. We've all seen "white elephant" properties or ones that don't fit the character or what's typical for the area. It's better to err on the side of caution. At the end of the day, the market will find the price for your property, not you. As I've said many times before: Real estate investing can be a great way to diversify your investment portfolio and earn passive-ish income. That's passive-ish, not truly passive income. Direct ownership of real estate still requires your attention and management. But what about the investor who is a busy professional, who wants to have exposure to real estate but just doesn't have the time to find deals, rehab them and manage them?

This series we put together, called "Real Estate Mail Box Money", aims to provide different options for the busy person to make their money WORK FOR THEM in real estate. The first installment that we posted a few weeks ago covers Triple Net Lease investing. This week, we will cover the topic of real estate private lending; the pros and cons and what to look out for when making private mortgage loans. What is real estate private lending? Real estate investors of all types and sizes utilize private loans or mortgages from everyday people to fund their deals and grow their businesses. Ever head, "you can buy real estate with none of your own money?" They are usually referring to the fact that it is possible to borrow money from private individuals to fund buy and hold rentals or fix and flips for investment purposes. Most people are under the impression that only banks make mortgages. But did you know that YOU could in fact be the bank? Active real estate investors like us borrow money from private individuals all the time and pay their lenders anywhere between 7% annual interest, all the way up to 16% in some cases! We also make private real estate loans too! There are a multitude of different reasons why investors decide to participate:

The Difference between a mortgage and a promissory note. When you lend your money to a real estate investor, you can secure the loan a couple of different ways. The most tried and true way to secure the loan is through a first position mortgage. This means that the mortgage is the most senior lien on the property. The way first position is verified is through the title search process done by the attorneys before the loan closes and proceeds are distributed. If there are any clouds on the title that would challenge the lenders lien position, they would need to be resolved before closing. That being said, ALWAYS make sure attorneys are involved if your objective is to be top of the heap as a lien holder! If your borrower insists on saving costs by not getting an attorney involved, run the other way! Besides a mortgage, the other way to secure your loan is via a promissory note that is secured by membership interest in the LLC that owns the property. The membership interest in the LLC that owns the property becomes the collateral in this case. If the borrower defaults, the lender can serve notice of default and sweep the membership interest to themselves and essentially take over possession of the property. This may be a tactic used when a borrower is borrowing the money for a down payment on an investment property when they are using bank financing where the bank's loan is in first position. The risk under this scenario is that the buyer can cloud the title with another mortgage for instance and render the promissory note less secure. For example, let's say I take out a promissory note to purchase a $100k investment property. Since the loan isn't secured to the title, I could go to my bank and put a mortgage on the property without the promissory note lender even knowing about it and thus making that lenders collateral position virtually disappear! How To Find GOOD Real Estate Investors To Lend To So if you want to get into the money lending game, where do you start in finding high quality investors who have high quality real estate opportunities? The first place I would recommend going is to your network! Do you know any active real estate investors? Reach out to them! If they aren't actively looking for funding right now, perhaps they know someone who is. Investors don't operate in silos, investors know investors. I, myself am good friends with dozens of other investors. If this approach doesn't get you anywhere, consider reaching out to a local real estate attorney you know. A real estate attorney probably has relationships with several investors, and they would probably not have a vested interest in introducing you to an investor who has gotten into money trouble before. Do you know any realtors? Everyone knows at least 5 realtors. There's bound to be one who has a relationship with a rock star investor who needs occasional funding! When you've found an investor, there are several ways to vet them to make sure they are a good risk. First there is vetting the individual investor and then vetting the collateral. How to vet the investor First, what's their reputation and values? Do they have a reputation of always doing the right thing? Do they operate by the golden rule? "Do unto others?" or do they operate by something else "Do it to them before they do it to you?" Second, how strong are they financially? Before I lend to an investor, I look at their balance sheet. How much cash or cash equivalents do they have? Do they have a cash position that will allow them to weather the storm if things get tough? What do their liabilities look like? Do they have a lot of personal debt and a lot of short term debt, that could come due at any point in time? How many other short term mortgages (like the one you are considering giving them) are coming due soon? How much real estate do they own? If they own and control a lot of assets, they generally have a lot to lose if they default on their loans. Generally, I operate by the banks principal philosophy. Only lend money to people that don't really need money. Ever notice that when you don't need money, the banks are pounding on your door? And the moment you actually NEED money, they are no where to be found? This is because banks are risk adverse and only want to make good bets on borrowers. How to vet the collateral Just because an investor passes the first test doesn't mean every deal is going to be the right one for you to lend on. First, I evaluate the location of the asset. Is it in a good location? An area where people actually want to live or work? Is it in an active high velocity market? High velocity means that there are a lot of transactions that take place frequently in that market and in that asset class. A low velocity market would be one that is typically very rural or economically depressed. A way to evaluate this test would be finding out what that average days on market are for properties in that area. Do properties generally sell in days when they hit the market or do they take months? A low velocity asset type can be one that is generally outside the realm of what's considered normal. As an extreme example, if the investor wants you to fund a purchase of an amusement park, that could be problematic. How many people are looking to buy amusement parks? Any niche asset type should be avoided unless the borrower has a rock solid plan to exit or add value in a way that would allow them to execute an exit strategy. Other niche asset types could be schools, churches, a nursing home, or any property that you would walk through and ask yourself "what the hell would I do with this thing?" Secondly, what is the property worth in it's current state and what is the after repair value (ARV)? Many lenders will ask their borrowers to supply comparable sales to establish this. I wouldn't rely on this information alone. I would do your own research. I receive information on projected valuations from other investors offering to sell me their properties or lend on their properties quite often. Sometimes the valuations are accurate, other times it draws data that is cherry picked by the investor to support a high valuation. If you don't know the area or property type and valuations, you might want to get a second opinion. Appraisers or Realtors can give you this type of information but there is a cost to it. This cost CAN be borne by the borrower. Although most hard money or private money lenders know enough about the general values themselves so to not need this additional opinion. Warren Buffet is often quoted as "I only invest in what I understand." You should follow the same mantra and if you don't know the market, either focus on lending on what collateral you understand or seek a second non-biased third party opinion. Other things to watch out for in commercial properties more specifically is environmental issues. For a buyer to get regular bank financing on any commercial property, their lender is going to require some sort of environmental due diligence. So if the collateral has any type of commercial use, whatsoever, your borrower needs to provide at least a Phase One environmental assessment on whatever you are lending on. AND from a local reputable environmental consultant. A Phase One is basically a research report on the history of the property and all of its historic uses. If there is any historical use or historical use of adjacent properties that could have created negative environmental impacts (think ground water contamination due to industrial or commercial uses), the environmental consultant will usually call for a Phase Two which would then take soil samplings and/or air quality samplings at the property to see if there are any existing environmental impacts that would need to be mitigated before a bank would be comfortable putting permanent financing on it. The reason why environmental due diligence is important is because you could get stuck with a property that you or your borrower wouldn't be able to sell or refinance to pay you back. As an added measure, make sure you share the results of any environmental due diligence and/or recommendations to a local lender to get their take on it to see if they would be comfortable offering financing on it. Some times a report will come back squeaky clean with no environmental concerns at all. Some times a report will come back with some type of nuanced concerns based upon the intended use. A lot of times the report isn't simply PASS or FAIL. This will be important information to know whether your borrower is planning on flipping and selling it or refinancing it and taking your loan out. Ways to fund loans if you don't have a ton of cash sitting around What if you meet an investor who needs $100k in funding but you only have $80k in cash? There are many professional full time money lenders who don't even fund mortgages using their own cash! They use lines of credit from their bank or investment management firm and borrow against other assets they own. Did you know that you can borrow against stocks and mutual funds as a line of credit? Many brokerage firms have low interest rate loans that allow you to borrow up to a certain percentage of the account value at a decently low interest rate. I actually do this myself when I'm funding other investors. I borrow it at 3% and lend it out at 10-16% (depending upon the risk of the deal) and make my money on the spread between the two rates. Sound familiar? This is what your bank does to your cash! They borrow it from you at 0.2% interest and lend it out at much higher rates! Another thing that some banks do is they will actually lend to you and use your private mortgages as collateral, sometimes up to 80% of the principal value of the loan! So you can fund a mortgage of $100k and get $80k back when you fund the loan, at which you can lend out again! As long as the spread is good and the loan is low risk, this can be a fantastic option to grow your loan portfolio! How to price your loans What interest rate should I charge? If investors are paying anywhere between 7% and 16%, shouldn't I only do loans at 16%? Your pricing should be based upon risk. For instance, a seasoned investor with a successful track record usually is not going to be accepting of private loans at 16% interest. If the only loans they could find were at 16%, they wouldn't borrow the money. Generally if the opportunity is solid and the borrower is solid, the going rate is usually going to be at the lower end of the spectrum. However if the collateral is junk, in a junk location, with a junk borrower then the borrower would expect to pay more. But then again, would that really be an opportunity that would be safe for your money? Warren Buffet also said, "Rule number one of investing is DON'T LOSE MONEY. Rule number two of investing: DON'T FORGOT RULE NUMBER ONE." I hope this helps you in your investing journey and we look forward to releasing Part 3 of Real Estate Mail Box Money in the coming weeks. If you are interested in participating as a lender or investor in one of our upcoming opportunities, please consider subscribing to the OakGrove Capital investor mailing list! If you're interested in learning more about how to scale your own real estate portfolio, don't forget to buy tickets to Go Big Or Go Bigger! bootcamp this coming July 30th in Rochester, NY!

OK I said it. Single tenant triple net lease deals are NOT real estate investments. At least, not in my book. They should be called tax efficient secured corporate bond investing. But before we can get into my clickbait-y annoying title, we have to get some definitions out of the way!

What is triple net investing? Single tenant triple net lease properties are all around us. If you've ever seen a Starbucks, Taco Bell, O'Reilly's Auto Parts or Walgreens at the corner of Main Street and Main Street in your area, it is usually a property that that particular corporation leases from an investor. A triple net lease is usually used in many different types of real estate asset classes. From retail, to office, to even industrial. It basically means that a tenant is responsible for all of the operating costs of a particular property. The tenant pays for all of the real estate taxes, repairs and maintenance, utilities, insurance, etc. What they pay in rent to the landlord is pure net operating income. The landlord has no operating expenses as it relates to owning the property. Single tenant triple net lease properties are a little different than other types of investment asset classes. If you buy a shopping center with multiple tenants on triple net leases, the landlord usually manages the payment of expenses and takes on the actual property management responsibility and then bills the tenants back for those operating expenses most typically on a pro-rata square footage basis for the maintenance of common areas (Common Area Maintenance or CAM). In the case of single tenant triple net, there is no management responsibility on the part of the landlord. It is truly mailbox money. How these deals usually come about is through the work of real estate developers. A real estate development company will have a relationship with a large corporation's real estate management department. The company will hire the developer to find sites that match very specific criteria. Typically, most retail businesses want to be on heavily trafficked corners in commercial areas with high residential density nearby. This is probably the most valuable real estate in any particular MSA. So you might wonder, "well if it's so valuable, why hasn't it been developed yet?" Many times, if the location is in an already developed area, there will probably already be a structure or structures already built there. This is why you will see an old Taco Bell knocked down and a Burger King built in it's place. I have even seen an older Starbucks get knocked down and literally have a Starbucks get built new across the street! The real estate manager will usually be responsible for achieving some goal of opening "x" amount of stores in a particular region within a particular amount of time. The developer will secure sites that conform to the parameters of the companies new store format, get them approved by that company's real estate department and then get the proposed project entitled by the local government, build it and then lease it back to the company on a long term triple net lease. Very often, the development company will not hold onto the property. They will either sell it immediately or sell it before it's even built, often times for a hefty profit! The reason why they dispose of it quickly is because the property starts to lose value after it becomes occupied by the corporate tenant (We will go into the reasons why later.) The typical buyers of these single tenant triple net leased deals are institutions (there are companies that specialize in buying only these types of assets, see local Rochester company Broadstone Net Lease.) Other buyers might be family offices, high net worth individuals or even insurance companies. The reason why they like triple net is because of the long term predictable cash flow, low management intensity and tax benefits (which I'll go into later.) So, why is it not real estate investing? Simply put you are buying a piece of real estate at a price that far exceeds its replacement cost. The advantage of buying currently existing property is that you can buy it a significant discount to replacement cost which gives you a built in competitive advantage. For example, a couple of years ago, there was a property for sale on 680 Monroe Avenue in Rochester, NY that was occupied by Starbucks. Case study below.

The property was about 2800 square feet, and sold for $868,400, over $300 per square foot! This is in a neighborhood where the price per square foot generally trades at $110 per square foot for existing construction. This is a reason in of itself why I wouldn't like this deal. Also you could build a brand new single story building for around $200 per square foot. So with this deal, most of the value is basically in the lease, not the real estate. Not only that, there was only 7 years left on the Starbucks lease. Beware of these types of deals. Typically the broker will market these properties that have shorter lease durations and be very loud about the fact that the tenant has multiple 10 year lease options or what not.

And that the reason their client is selling is to pursue "other opportunities", otherwise they would hold onto the property, etc. Remember, the seller probably knows more than you. They probably know that Starbucks is only building new stores in tertiary markets like Rochester, NY on highly trafficked corners with drive thrus and with very limited seating. Furthermore, the lease rent of $19.63 a foot double net, is $10 more per foot than similar rent comps in the subject property's location. And those rent comps are either gross plus utilities or modified gross leases. So if Starbucks ended up vacating at the end of their lease, you'd be taking a hair cut on the market lease rent. So how did this story end? Starbucks ended up closing this location (aka going dark). Although the rent is guaranteed by the corporation and will likely be paid through the end of the lease term, you know that the likelihood of them renewing is not likely. The lesson here is, if you are going to consider purchasing a single tenant NNN property, you will want to do some research and due diligence on what corporate store model that company is currently using. You can perform this research quite simply by looking around your market and other comparable markets to see the specifications on what is being currently built and where.

For example, back a few years ago, Dollar General updated it's store format so that it would only consider opening new stores that had at least 8000 square feet, a certain number of parking spots per square foot, ceiling height, etc. The photo above features a Dollar General that is for sale with 2 years left on it's lease. Take a look out there at newly constructed Dollar Generals.

The above DG was built in 2021. It has high ceilings. It is a 9100 square foot stand alone structure with its own large parking lot. When you do research, all stores that have been built since 2020 share similar specifications. So when you compare it to the deal with 2 years left on its lease, you have to think... What would stop a developer from finding a site right down the road and building a brand new Dollar General with the updated store specifications? Sounds like a lot of downside risk and not a lot of upside when considering buying something with not a lot of duration left on the lease.

So now that I have illustrated some of the risks involved with investing in single tenant NNN. There's got to be benefits, right? I mean why would instutional investors like pension funds and life insurance companies have an absolute love affair with this type of product if it was junk. First of all, single tenant NNN is not junk. There are a myriad of benefits but it has a lot of characteristics to it that make it very unlike other forms of real estate investing. The above photo is of a Walgreens NNN deal located in Canandaigua, NY. The price is $7.6 million. It's about 14,000 square feet. It has 10 years left on its current lease and it's current net operating income is $456,000 annually. At an asking price of $522.88 per square foot, why would someone even invest in something like this and pay nearly 5x over other comparable properties? By the way, this property is already sold! The reasons that make an investment like this attractive are as follows:

Things to watch out for in Single Tenant NNN. With all of this bad stuff I said about NNN, I will probably be a buyer of Single Tenant NNN investment properties in the future when I am looking for low management and predicable sources of fixed income. However, I think it is antithesis to many reasons why we invest in real estate. It involves buying a property at a significant premium to replacement cost, which buys you no margin of safety if things go badly. Having a lease with a tenant that is significantly above market rents, which is fine while the tenant is there and paying but not good if things go sideways. So that being said, if you are going to take the plunge and strongly consider investing in single tenant NNN deals, here are some things to watch out for.

Well I hope this answers some questions you might have about a little known investment strategy. If you got value out of this, please register for our monthly newsletter below!

Leasing up residential rental property versus commercial rental property is vastly different. This is the way most residential investors or property managers lease up residential property:

Also many of the best prospects for your space might not even be looking at your space, or not looking for space period. Your best prospects are people that are already in business and lie somewhere on the growth curve of their business and quite possibly might not even know they need space yet. If this is the case, how do you make your best prospects aware that your opportunity even exists? Here are some tactics that we use to get that visibility and get the buzz going about our harder to lease vacant commercial spaces. the "just show it" method

If people don't know your space exists, how can you make them aware of it if they aren't looking? The answer: show your space to anyone and everyone you possibly can show your space to. Even if they aren't looking. Even if they don't even have a remote possibility of being a prospective tenant. Are they involved somehow in the industry that you are targeting for a given space? Then show them the space. For instance, if you are targeting a restaurant operator for your available space and you know someone who sells food to restaurants, can you see how it might be helpful if see your space? They talk to restaurant owners every day. Are they well connected in your community? Then show them the space. These super connectors seem to know everybody and can help make a connection to someone who might be a good prospect for the space. Some tips for the "Just Show It" method. Call this person up and say "hey I have a really cool space I'd like to show you. Want to grab some coffee and check it out?" Some people are harder to track down than others, but none of my "Just Show It" victims have never said "No." And they were always appreciative of the experience. Just don't be all pushy about it and show them with some agenda in mind. Remember, this is a walk and talk. They most likely don't have user in mind. And even if they did, that user might not even be looking for space right now. Just show them the space with no hidden or apparent agenda. Some things I find of value in this process is having some type of knowledge concerning the history of the space, the building and the neighborhood. Believe me it works when you can tell some type of story. It enriches your tour goers experience and has them commit it to memory. Have you ever been to some beautiful historic place without a tour guide, and then gone back to that same place with a great tour guide? Become the tour guide. For instance, our building at 53 Canal Street is an old chewing gum factory. We hired a historic consultant to do a little write up on the building, the neighborhood and the companies that used to inhabit it. They also curated old photos and adverts from the companies that used to be there too, to aid in our marketing efforts. Chewing gum! How sweet and cute is that? Another important tip is to talk about some type of vision you have for the space or the property. You probably aren't going to be the end user of the space so the end vision, and what actually ends up happening is not going to fit perfectly with your vision. But if you have a vision that you can communicate to someone, it can get their creative juices flowing and get them thinking about the possibilities for your space too. Make sure when you talk about your vision its not hard and fast. There are many of our spaces that we envisioned being a skee-ball hall, a distillery, wine bar or brewery, that turned out being used as a gym, a vintage clothing / barber shop, or a crumpet shop! As you can see, if it was up to us alone, we'd have alcohol involved in every one of our spaces ;-) My favorite prelude to a sentence when I'm talking my vision and walking our space is "If you could imagine...?" At the end of the day, it's someone else (your tenant) who's imagination is going to drive the end use of your space.

Case Study on the "Just Show It" Method:

One of our spaces at 441 Monroe Avenue was used as a creepy nail salon for decades. One of the visions I had for the space was a champagne bar. I posted the space on Loopnet, Costar, Craigslist and Facebook Marketplace for over a year and most of the inquiries I got about the space was nail salon users, barbershops and salons. In addition to this traditional marketing, I called many people I knew and "Just Showed" the space to anyone who might be able to give me ideas. After several hundred showings, I found someone who had a friend who had been talking about opening a crumpet shop for years. Long story short, this is how we married Crumpets. to Monroe Avenue. If you are wondering what a Crumpet is. Just go there! It's a weekly stop for me and my daughter Holly! The "Have a Party" MEthod

Want to get a bunch of people into your building? Have a party! If you have vacant space, chances are there is some type of value in use by someone for that space. Even if it's temporary. Here are some tactics we have used for getting people into our spaces and creating buzz about our projects.

Case Study: The Market On Canal A few months ago, we acquired 53 Canal Street, the historic Pulver Chewing Gum factory. It is a three story 16,000 square foot brick building with high ceilings and open floor plans. After we cleaned the building out, we said to ourselves "this would make a great pop up market!" And thus The Market On Canal was born. The market is a bazaar of local artists and makers that we curate and create a market for their creations. We have some 15-20 visual artists, photographers, jewelry makers, culinary artists, vintage goods, hand made lighting, and we've even had a local ice maker who creates for the craft cocktail scene! We rent booths out to these folks and use the booth revenue to bring in a musical artist to provide live music for the event and to pay a local artist to do paint a live mural during the market event as well. An event like this will have gravitational pull for people to come into your subject property's neighborhood and your building. The participating artists and makers want the event to be a success as well as us so they help cross promote the market event to their sphere of influence. Think about it. If each event participant has a thousand people in their sphere of influence and you have 20 vendors, that's over 20,000 people that have the possibility of being aware of the event. Not saying that everyone one of those people will come but the more people that are aware of it, the more that come. And even for those people that don't come, they definitely become aware of the event and therefore the building. We have only had two of these market events so far and have already landed a pretty large tenant out of it. So it definitely works! A market event like this takes a lot of work to organize and execute, so if you don't have the band width to pull it off, you can organize something as simple as an industry happy hour / open house for local real estate brokers. Getting brokers into your space can help you lease up your projects. Just because your listing is on Costar and Loopnet doesn't mean that a broker tenant rep really knows your space. They might have met a possible tenant years ago and talked about space needs and there wasn't anything available that met their criteria at that time or maybe they weren't ready. These types of opportunities get forgotten, until... In my experience as a real estate broker, sometimes it takes me visiting a space and then all those memories of that encounter with that tenant are all conjured up and I have that Eureka! moment. "This would be perfect for them!!!" Imagine the possibilities that could come about if 20 to 30 brokers were in your space having some cocktails and eating snacks! Partner with the arts community

The arts community does so much for cities across the nation. They bring life, vibrancy, culture, and help build tremendously with placemaking. There are some communities that I have visited that are devoid of artists communities because artists quite simply have been squeezed out. These places usually all look the same and sometimes you have to check your maps app to realize where you really are. Artists help create the unique identities of the cities we cherish, love to live and visit. If you have space you can afford to give up even temporarily, consider partnering with the arts community and donate your space. It doesn't have to be long term. It could be for a program or series of programs, a show, or something longer term. Having vacant commercial space is like cancer for your building. Nobody likes to be in a building that feels dead so we have partnered with arts based organizations to bring additional life into our buildings. Here are some examples below!

Case Study: Current Seen Rochester, New York has a very strong arts community and our creatives are always looking for space, either to host a gallery or exhibition or a space in which to create art. Usually the price tag or terms for space of this use on the open market are usually not economically sustainable. If you have vacant space, why not donate it for this use? We have partnered with arts organizations in the past with great success. Back a few years ago, we partnered with Rochester Contemporary Art Center for their program Current Seen. Current Seen is a biennial small venue public art processional focused around the main corridors of our city in Rochester, NY. By partnering with Current Seen, we donated some space at some of our buildings to host art installations curated by ROCO and other ROCO partners. This gained a lot of visibility for our buildings and opportunities in our spaces. Above is one of the installations at one of our buildings in 2019 Current Seen titled This Heirloom by artist Mara Ahmed - Link To Installation Info Here

Case Study: 9th Floor Artists Collective

Back a few months ago, we collaborated with RocGrowth to offer studio and arts education space to a grassroots artists collective in one of our buildings downtown (photo of some of our group above). Although still in its early stages, the members of the collective have already mobilized and begun scheduling programming within the space including arts education classes and art shows. Some of the programming that they are planning on is street level guerilla art which we are really excited about. In downtown Rochester, our main streets downtown tend to wind down after 2:00pm during the week and becomes a ghost town on weekends. Stacking different creative uses in our building will shake things up from the traditional office use that we see so prevalent downtown. With the growth in downtown residential living options, our neighboring residents are going to want to see life and activity at the street level while they are home at night and weekends. We are hopeful that this will not only be complementary to that aim but also inspire other property owners and developers to do the same. If you found value from this, please consider subscribing to our newsletter! Our aim is to entertain, engage and educate! And also if there is any content you wish for us to cover please let us know!  Happy New Year from the OakGrove team! As we all look into 2022 and chart our goals and aspirations for the coming year, we start to think about what we want to accomplish and WHO we want to accomplish our goals with. No one person is an island. Any audacious goal that we set for ourselves is going to involve the alignment with other people and leveraging others talents. These people can be employees, vendors, lenders, professionals, investors (limited partners), and/or general partners. What I want to focus on in this post is partnerships. Partnerships, when structured correctly by your legal and accounting professionals can be an incredibly effective way to scale a real estate business or any business for that matter. Partnerships, in an ideal world, can leverage core competencies of its members and create an alignment of interests towards a common goal, while sharing in the risk and reward on a particular venture. For example, if you are a real estate developer or investor like OakGrove, you might be very good at finding new investment or development opportunities and raising the funds within which to take advantage of those opportunities, but you or your organization might be very lacking in the skill sets of project management and construction that is needed in order to successfully execute on a plan for that opportunity. No one individual or organization is extremely good at everything and sometimes creating a formal partnership with someone who counterbalances your weaknesses can be very effective in lowering the risk of a given project and increase the probability of success. As an individual, I have created partnerships with several individuals and organizations throughout my years. Our company continues to create partnerships with investors, contractors, and even other development companies. Some of these partnerships have been huge successes. Some of them were successful but created a ton of heart break and brain damage in the process. Some have been absolute disasters. What we have learned in this process is a few things that we hope that will help you in scaling your business through partnerships. For the purposes of this blog post, I define Partnership as a limited liability company between two or more members.

http://www.oakgrovecompanies.com/roc-blog/how-to-set-up-an-exit-strategy-from-a-real-estate-partnership I hope this was helpful to you. We would love to hear your real estate or financial goals. Talking real estate and money is a passion of ours so if we can help in anyway, please don't hesitate to connect with us!

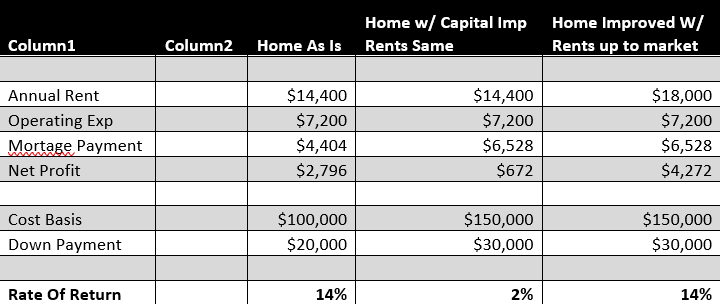

To whomever may care, My name is Matt Drouin. I own a real estate development company and have been providing high quality market rate housing in the City Of Rochester for 15 years… it's story time... “I’M GOING TO F****** KILL YOU! OPEN THE DOOR! OPEN! THE! DOOR!” BANG BANG BANG BANG BANG BANG BANG BANG 2:37am – I look over at my phone and realize what time it is. Then I hear my 18 month year old daughter screaming in her bedroom. I’m wondering, “What in the hell is going on?” BANG BANG BANG “OPEN UP THE F****** DOOR YOU GOD DAMN MOTHER F*****!” I look out the window next door and it’s some woman clearly out of her mind coming down off some substance; trying to scratch an itch. Pounding on my neighbor’s door. The reason I know this? My neighbor who moved in several months ago is a drug dealer. How do I know this? Comings and goings of random people all night and all day. This isn’t friendly house calls. It's trembling people. Dark circles under their eyes, who look like they haven’t slept in days. People who ask me for money or cigarettes or looking to sell me something hot and convert it to cash to patronize my next door neighbor. I have contacted their landlord Providence Housing (A supportive/transitional housing agency) and they can do nothing. They say they don’t have the evidence they need like police incident reports to get my enterprising neighbor out. I have called the police several times upon incidents like these and by the time they get to the scene (which is usually quite a long time.) The “customers” have disappeared or are inside the dealer’s apartment. No incident to report. The officer instructs me to call the neighborhood service center to report these types of things. Basically saying in not so many words, “we have enough to deal with right now, call us when this thing really blows up.” I usually come back into the house, and expect the usual admonishment from my wife. “Don’t call the police! What if that guy does something to us?” We then live the next few days with our neighbor staring us down when we see him out front of our house and us having to leave all the lights on in the house. Make sure every door is locked. Security system is armed. Sleeping lightly or not at all. Stirring at every little sound. Hoping for the best. Praying for no retaliation. I contact the Neighborhood Service Center and they tell me to call the police with issues like this. What can be done? Apparently, nothing. What does this little story have to do with housing policy? Well, under usual circumstances, the landlord, Providence Housing, might not be able to get this neighborhood terrorist out through traditional eviction (because there is not enough bona fide evidence to hold up in eviction court), but would be able to get them out when their lease expires through what’s called a hold over proceeding. A hold over proceeding is when a landlord gives notice to a tenant that they are deciding not to renew their lease when it expires. If the tenant overstays beyond their lease expiration (aka holding over) the landlord can file for eviction in order to recover possession of the rental home. There may be many factors in why a landlord may decide not to renew a tenant’s lease, but the most common one is behavioral. Behavioral issues like my neighbor. Being a nuisance to neighbors or any type of irresponsible behavior that affects the neighborhood or property in a negative way. Under new legislation being considered by city council, my enterprising next door neighbor would have the right to lifetime tenancy with little to no recourse besides me taking matters into my own hands or moving out of the city. Neither of which option is particularly attractive. This legislation is called the Good Cause Eviction law (which was just passed in Albany; the text of the law is in the file above.), which would give a tenant the right to stay in their apartment or rental house for their entire life if they chose to, as long as there wasn’t a “Good Cause” to evict them. A “Good Cause” to evict would be nonpayment of rent. Unless crack cocaine and heroin becomes legal, I don’t see an interruption of income to my neighbor happening anytime soon. A “Good Cause” to evict would be documented behavioral issues, like police reports. Like I had mentioned earlier, I haven’t been able to get any police reports because apparently there isn’t anything to report. My good neighbors, mostly Providence Housing residents, do not want to call the police or the neighborhood service center because they are afraid. If you don’t think this fear is real, you are out of touch. A fifteen-year-old was just shot and killed in our city with no suspects and no person of interest. How many times do we hear about a child being murdered in our streets and even their parents are afraid to cooperate with the police? If this story wasn’t enough for you to question Good Cause Eviction, keep reading… There is an affordable housing crisis in Rochester that has been around long before housing affordability became a topic of discussion with policy makers like yourselves. According to the National Low Income Housing Coalition, Monroe County has a shortage of over 50,000 affordable housing units, with most of that housing need being in the city of Rochester. This means that there are over 50,000 households that do not have housing or are burdened by housing costs as it relates to their income (spend at least 30% of their income towards housing costs.) These facts when compared to what you see in the media about the great affordability of housing in the Rochester region are simply confusing. How can we have some of the least expensive housing in the nation for a metropolitan area yet have this housing affordability crisis? (In fact, there are many areas of the city where the housing is so cheap, banks wont even provide financing.) The short answer lies in income inequality not housing cost. We have an income problem, not a cost of housing problem. Combine this with the trend of suburban (mostly) white people desiring to live in dense urban environments and you have what looks like gentrification, or colonization. So it becomes very easy for policy makers to go to the root of the problem at face value, and want to support policies that will curb the increases in the rents that outpace local incomes. It is no wonder why you support Rent Control aka Good Cause Eviction in Rochester, NY. It’s a quick fix. Quick fixes are never good. As Italian philosopher Umberto Eco once said: “for every complex problem there’s a simple solution, and it’s wrong” Here are some reasons why the Rent Control legislation you are considering is short sighted and disastrous towards race equity, creating housing options for low to moderate income renters, and even deleterious to current quality housing options. Any new housing is good housing. We need more housing units in our community. Not just the low income housing units as created by the Low Income Housing Tax Credit through affordable housing developers. This is important, but also preserving investment in existing housing stock, as well as creation of luxury housing for high income earners that choose to live in our city. Fact, increasing supply moderates rental rate increases over time. Fact, it broadens the tax base to support city programs. Fact, higher income earners are usually not net consumers of public resources. And luxury housing, most namely decreases competition amongst tenants over rental units that were originally out of reach to them in middle to upper middle income areas like the South Wedge, Park Avenue, and Pearl Meigs Monroe, just to name a few. The reason why I name these neighborhoods is simply because this is where most of my properties are. With the increase in supply of “luxury” apartments, we have seen the average income of our applicants go down as our high income tenants have left our communities to relocate to amenity rich high income housing. This is not necessarily a bad thing. The tenants what we were getting before "luxury" supply went up were making sometimes $75,000 to $100,000 annually on average and applying for an $800-$900 apartment home that we had. Now that they have more options, they are gravitating towards higher priced units. What we have seen in response to this phenomena is that there are more BIPOC tenants moving into our communities. As a result we have seen more mixing of incomes. At the same time, as a community at large, we are retaining higher income earners, which have the substantial disposable income to support essential retail that we all want to see in our communities: grocery stores, boutiques, restaurants and bars. Additionally, we have even seen employers respond to this trend by relocating their businesses to where their employees want to live. High income earners moving into an urban area can sound scary. But, the diversity of incomes not only supports these essential urban amenities but also helps to mix people of different races, ethnicities, sexual/gender orientation; to help build connections, build community and tear down the walls of structural racism that were the result of racist housing policies of government and banks which helped exacerbate racial segregation and all of the urban disinvestment along with it. Urban Disinvestment Round 2 Since the passing of the Housing Stability And Tenant Protection Act of 2019 (HSTPA), we have started to see the precursors of disinvestment. Collecting rent is the life blood of supplying housing of any kind. Rent collection is the biggest challenge in supplying housing to low and moderate income people. Tenants in this income segment tend to struggle with juggling and prioritizing paying bills due to income relative to their contract rent. A flat tire on their car can spell a financial crisis that can cascade into eviction. When the HSTPA passed, there was a marked change in the way tenant’s prioritized paying rent. Since the act gave them significant time to pay (almost 3 times as long), it jeopardized the sustainability of the landlords business. To be clear, the rent tenants pay is not pure profit. The landlord is a steward of that money and assumes the role of a private money manager. They take that rental income and pay all the bills associated with maintaining that property which include paying for utilities, real estate taxes, insurance, repairs and maintenance, property management fees, mortgage payments and also setting aside money for capital expenditures for future big ticket items (roof, HVAC, windows, etc.). After all those things are paid, the landlord hopefully takes a profit, but sometimes not. Once the regulations of the HSTPA were fully digested, some landlords that serviced low income residents started to sell their properties because their job became much harder and in many cases not economically viable. If that wasn’t enough, COVID 19 hit and those same landlords had to deal with an eviction moratorium that has gone on for almost two years. There are many of my colleagues who have been selling their properties and for the most part they have been getting bought up by out of town and even out of country investors, who have no connection to our community. Since they are disconnected by distance, they usually don’t maintain their properties as well (by routine maintenance standards or capital improvement standards). This phenomena is all well documented in city code enforcement. Furthermore, whatever profit they do make is extracted from our community and exported to wherever they live to support the economics of their community, not ours. In my experience these houses usually end of going to tax foreclosure and enter the revolving door of the foreclosure auctions until they become boarded up and vacant. At that point, the property usually needs more capital improvements than it is worth; becomes fully extracted. What is troubling about rent control is that it dicourages property owners from investing in their property. Under rent control, why would I buy a property that needs a new roof, new windows, new HVAC, new everything if I can only increase rents 3%. I cannot finance those capital improvements with debt or private investment while maintaining significantly below market rents. The only way I could potentially finance those improvements with keeping rents significantly the same, would be to buy the property for substantially less. Let’s run a scenario on a real property for illustration purposes. There is a 2 family property in the Beechwood neighborhood for sale where the asking price is $100,000. It features one apartment that is $650 a month and one that is $550 a month, so the annual gross income is $14,400. The annual operating expenses are $7200 a year and they include: real estate taxes (based upon an assessed value of $69,000), vacancy and collection loss, management fee, insurance, repairs and maintenance, utilities, etc. The house needs a new roof ($13,000), 2 new furnaces ($10,000), new windows ($7,000), and vinyl siding ($20,000) adding up to a total of $50,000 in needed capital improvements just to make the house safe to live in. This doesn’t include any interior cosmetic improvements needed. The inside is very much run down. I include three financial analyses below. The 1st scenario is if an investor bought the house and kept everything the same and did no improvements. 2nd scenario is if the investor bought the house, kept rents the same, but performed the necessary improvements. The 3rd is investor bought the house, increased rents up to market rates ($650 for the 1 bedroom and $850 for the 2 bedroom) and performed the necessary improvements. The analysis assumes the investor buys the house using conventional financing, putting 20% down, 30 mortgage, 3.571% interest. It also assumes no increase in real estate taxes. But we all know that the taxes will probably go up once the assessed value is brought up to what the investor paid for the property. If you review the chart above, you will see why so many investors (Extractors) in lower priced neighborhoods do not perform improvements on their properties, and they continue to deteriorate. And often times, these investors that do the bare minimum also have below market rents too, reference Clinton Lofts and many other recent housing atrocities as an example. So if Good Cause eviction is passed, the only way the investors can make a reasonable return on investment is if they buy the property and do nothing, or to buy the property for $50,000, half of the asking price. Which investor do you think will prevail in purchasing the property in an open market? The Extractor or the responsible property investor? And even if the responsible housing provider is able to purchase it for $50,000, it’s not necessarily good for the neighborhood in terms of building neighborhood home equity and supporting neighborhood stability.

Solutions To The Housing Affordability Crisis

This affordable housing crisis is real. But the responsibility for its cure cannot be borne by housing providers alone. These housing policies that have been enacted over the last several years further exacerbate the crisis. Here are some suggestions that will actually help alleviate this crisis. 1.) Expand and increase Section 8 housing voucher program. Solving income inequality will take generations to fix. But in the meantime, people need quality safe housing. Increasing the vouchers will give lift to the supply of quality naturally occurring affordable housing. If people have a larger budget to secure housing, that increase in demand will stimulate increase in supply and spur competition of responsible housing providers to compete for that business. The reason I have to keep my tenants happy is because they can choose where they want to live. If I fail them, they move. The only way I make money is by retaining tenants. Not churning and burning every year. The reason they have this choice is because they have the income to secure whatever housing they desire. Expanding Section 8 vouchers is also very important. People wait years to get on Section 8. In the meantime, their housing need persists. People shouldn’t have to wait years. 2.) De risk rent collection for Section 8 housing providers. The reason why many landlords discriminate against Section 8 is primarily due to payment risk. A section 8 housing voucher usually only covers a portion of the rent payment obligation. The landlord has to not only collect rent from Rochester Housing Authority (who administers the Section 8 voucher program) but also has to collect from the resident as well. This portion can be a substantial portion of the overall obligation. Solution: have tenants pay directly to Rochester Housing Authority and then they cut one check to the landlord. By RHA becoming the sole bursar of funds and guaranteeing 100% of the rent, it eliminates perceived payment risk. This would come with the responsibility of the landlord maintaining the housing with standards that would have to be maintained through the routine Section 8 housing inspection program. At the end of the day, landlords just want to do their job and get paid, period. So if you can eliminate that risk, you would attract more housing providers into the business of naturally occurring affordable housing. In the meantime, if the tenant falls behind on paying their portion to RHA, RHA can leverage their resources and networks to get their clients connected to the resources they need. 3.) Housing reactivation grants. According to the city of Rochester Building Blocks website, the city has 1,255 vacant residential structures of 1 unit or more. This is actual structures, not unit count. If a two-family home is vacant, it counts as one vacant structure. The city should offer developer fees, grants, or soft loans to small developers to reactivate vacant housing stock and convert it to affordable housing. HCR (Homes And Community Renewal) have a similar program where they incentivize larger developers to create affordable housing units and issue soft loans of $50k per unit to do so. The loan has a term of 15 years at 1% interest and is essentially forgiven after 15 years as long as the developer complies with keeping it affordable for the term. The city should pilot a program like this on a small scale and establish focused investment strategy areas located in marginal neighborhoods along main thoroughfares right on the edge of more stabilized areas. This would ensure long term affordability in bands that might be susceptible to resident displacement. The program could be used for rehabbing housing and selling to income eligible owner occupants as well. The city needs to partner with for profit housing providers in order to help meet demand. Low income housing tax credit affordable developers are an arrow in the quiver, not the magic bullet to solve all housing issues. Small for profit housing providers are more nimble and cost effective than the LIHTC developers. For example, Cedarwood Towers, a 206 unit apartment building was renovated in 2019. They utilized all of the tools at their disposal for affordable developers: Tax Exempt Bonds, Low-Income Housing Tax Credits, HUD, and LIPHRA. The cost? $41.6 million dollars, or over $200k per housing unit. And that was a renovation not a ground up new build. Ground up new builds cost over $300k per unit to build for affordable housing developers. A large portion of these inflated costs has primarily due to the soft costs associated with these developments and inflated hard costs associated with arduous compliance. Meanwhile, single family houses within a quarter mile radius or Cedar Towers are selling at a median price of $151,000 for a 1300 square foot, 3 bedroom, 1 bath house! A house! Not an apartment buried and siloed in some creepy high rise tower. Plus a private housing developer can reactivate vacant housing stock in less than one year. Affordable housing developers take years to create one housing project. So why don’t we pilot this program, establish a proof of concept, in order to create case studies to lobby HCR and other agencies to help create a streamlined program that can be more adequately scaled to our housing needs locally? 4.) Utilize Current Code Enforcement To Increase Housing Standards. This is the scalpel vs. hammer approach that should have been utilized a long time ago to root out slum lords. Instead recent housing policy changes have been made with good intentions but have punished everyone involved with the providing of housing for low to moderate income people. Code enforcement has been lax on enforcing better housing standards for existing housing. Therefore, there are properties that I visit and drive by every day that have fully unconditional certificates of occupancy which are ramshackle. I am not recommending that code enforcement go gestapo right now because there are many providers of affordable housing which have been completely decimated in the wake of the HSTPA and eviction moratorium. But code enforcement knows the usual suspects who don’t play by the rules and they need to be held to the same standards as everyone else. You see, the good people out there WANT to play by the rules and therefore seek authority in support of what their objective is... and then they get punished. For example, I pull building permits quite often and every time the process is a nightmare. The bad guys just do whatever the hell they want and barely get a slap on the wrist. Because in our environment currently, it’s easier to be bad.

If you own 2 or 3 investment properties and are trying to figure out how to replace the income from your job, you know that it will take a long time and purchasing many properties to earn your financial freedom. Buying commercial property can dramatically fast track your financial goals! It certainly did that for me. One commercial deal can change your life. The first million dollar commercial investment property allowed me to pay for my daughter's college education. The second one I did, paid for my wife's early retirement. In order to achieve those scales buying small residential, you basically have to be a deal junkie running on a hamster wheel!

These are the four things you need to know about what's different from residential when buying commercial investment property. But before we get into that, what is the difference in terminology from commercial and residential real estate? Residential real estate is anything that is single family through four family. Anything 5 units residential and above is considered commercial. Anything that has a use, even a partial use of anything besides residential is considered commercial real estate. For example, a property with a retail store front and two residential apartments on top (a typical mixed use building), would be considered commercial, even though there are less than 5 residential units. Ok, now for the four biggest things to consider between the two real estate classes:

|

AuthorThis blog serves an an outlet for all of our invaluable team members to share their insight on development, property management, and all things affecting real estate in our community. Archives

July 2023

Categories |

||||||||||||

RSS Feed

RSS Feed